Question: Question 5 11 points possible (graded) Suppose there are two mutually exclusive projects. Project X requires an investment of $150.0 million now, i.e., in Year

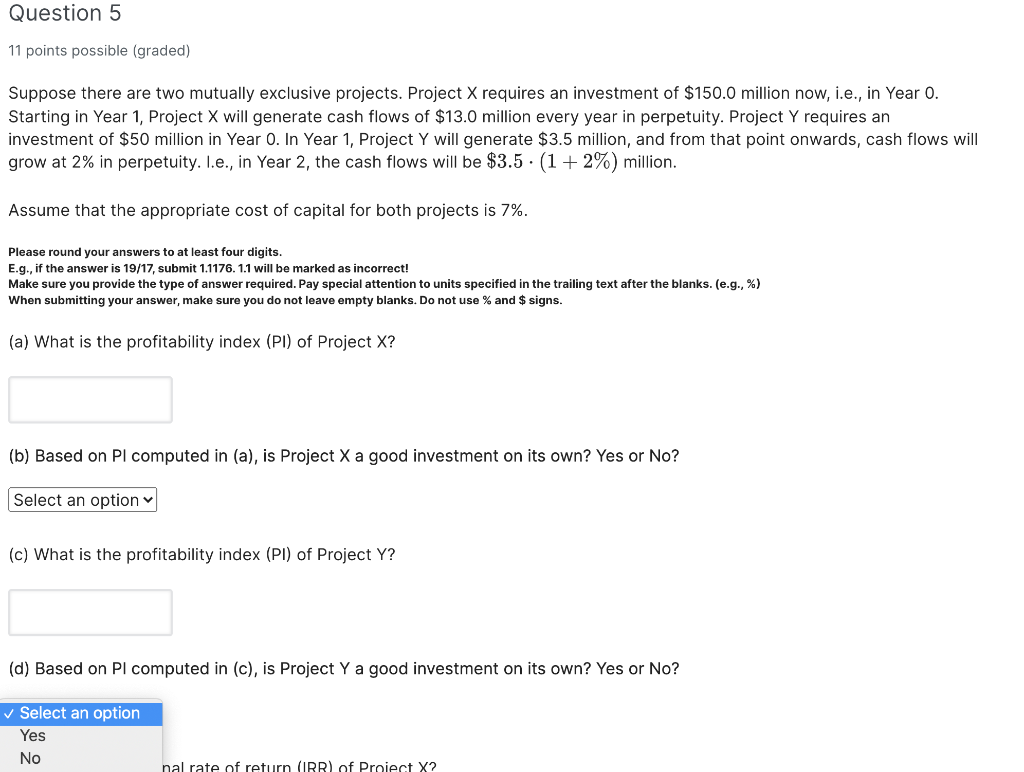

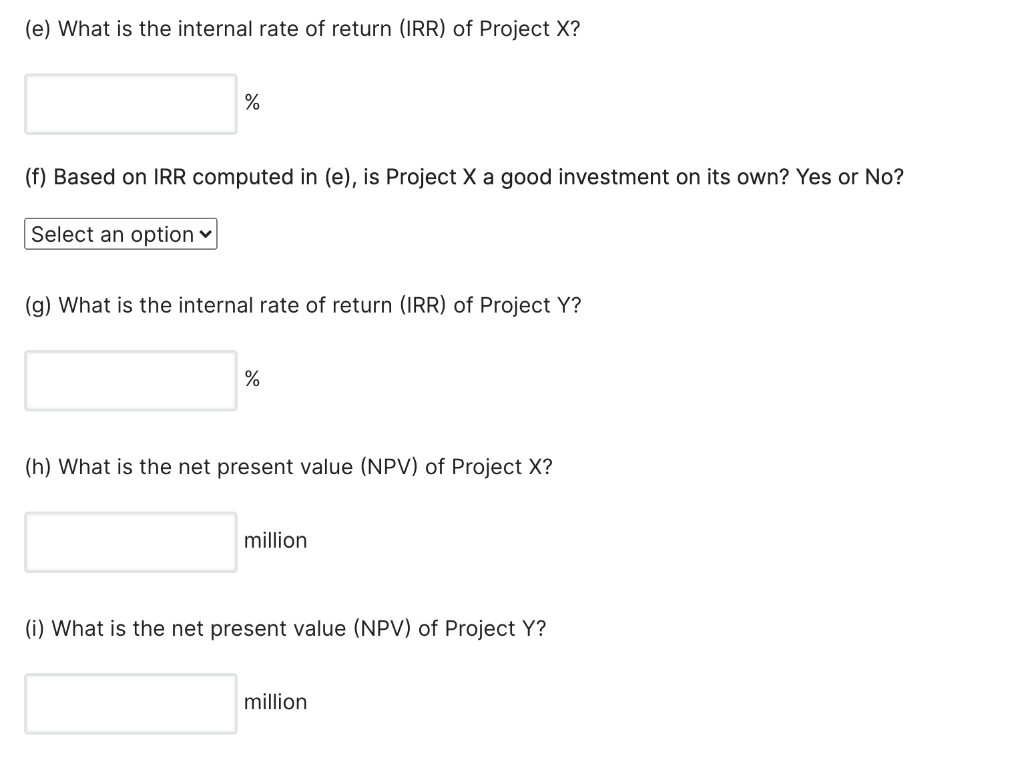

Question 5 11 points possible (graded) Suppose there are two mutually exclusive projects. Project X requires an investment of $150.0 million now, i.e., in Year 0. Starting in Year 1, Project X will generate cash flows of $13.0 million every year in perpetuity. Project Y requires an investment of $50 million in Year 0. In Year 1, Project Y will generate $3.5 million, and from that point onwards, cash flows will grow at 2% in perpetuity. I.e., in Year 2, the cash flows will be $3.5. (1 + 2%) million. Assume that the appropriate cost of capital for both projects is 7%. Please round your answers to at least four digits. E.g., if the answer is 19/17, submit 1.1176. 1.1 will be marked as incorrect! Make sure you provide the type of answer required. Pay special attention to units specified in the trailing text after the blanks.(e.g., %) When submitting your answer, make sure you do not leave empty blanks. Do not use % and $ signs. (a) What is the profitability index (PI) of Project X? (b) Based on Pl computed in (a), is Project X a good investment on its own? Yes or No? Select an option (c) What is the profitability index (PI) of Project Y? (d) Based on Pl computed in (c), is Project Y a good investment on its own? Yes or No? Select an option Yes No nal rate of return (IRR) of Proiect X2 (e) What is the internal rate of return (IRR) of Project X? % (f) Based on IRR computed in (e), is Project X a good investment on its own? Yes or No? Select an option (g) What is the internal rate of return (IRR) of Project Y? % (h) What is the net present value (NPV) of Project X? million (i) What is the net present value (NPV) of Project Y? million (j) How does the ranking of projects X and Y based on Pl coincide with the ranking based on NPV? Select an option (k) How does the ranking of projects X and Y based on IRR coincide with the ranking based on NPV? Select an option NPV and IRR both higher for X NPV and IRR both higher for Y IRR higher for Y, NPV higher for X IRR higher for X, NPV lower for Y empts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts