Question: Question 5. 1-3 PART QUESTION. PLEASE DO ALL 3 & EXPLAIN IN DETAIL. If correct I will give a rating. Homework: Chapter 11 Homework Question

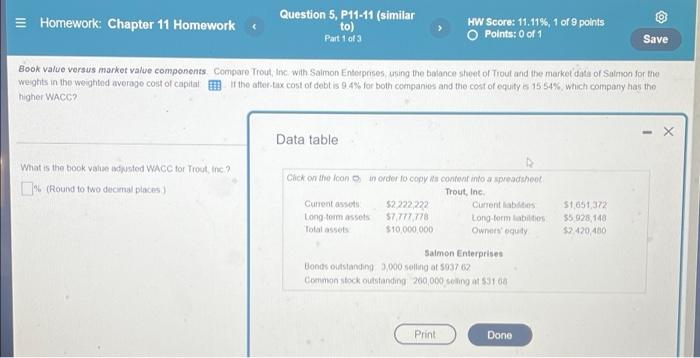

Homework: Chapter 11 Homework Question 5, P11-11 (similar to) Part 1 of 3 HW Score: 11.11%, 1 of 9 points O Points: 0 of 1 Save Book value voraus market value components. Comparo Trout Int with Salmon Enterprises using the balance shot of trout and the market data of Salmon for the weights in the weighted average cost of capital the after tax cost of debt is 94% for both companies and the cost of equitys 1554% which company has the higher WACC) Data table What is the book value winted WACC for Trout, Inc.? (Round to two decimal places) Chick on the icon in order to copy content into a beadshot Trout, Inc Current assets 52 222 222 Current labas Long term assots 57777778 Long form abilities Total assets $10.000.000 Owners equity 51651372 55 926,148 $9.420,480 Salmon Enterprises Bonds outstanding 3,000 coling at 5037 02 Common stock outstanding 210.000 cong at 53100 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts