Question: Question 5 (17 Marks) As a stockholder in Bio Lab, you receive its annual report. In the financial statements, Bio Lab has reported that the

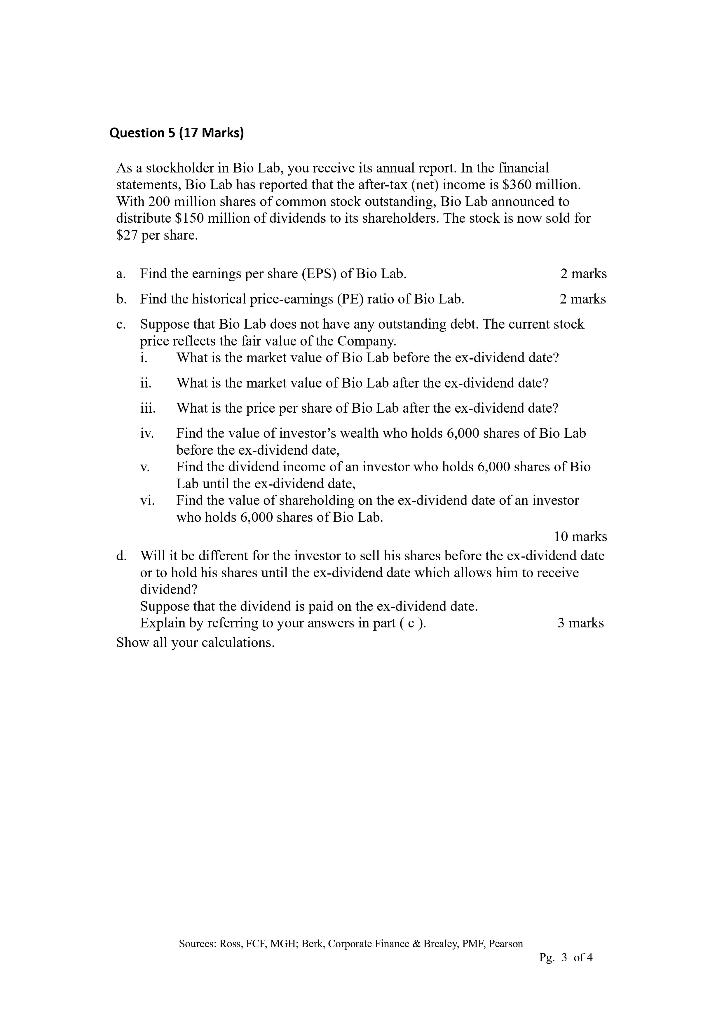

Question 5 (17 Marks) As a stockholder in Bio Lab, you receive its annual report. In the financial statements, Bio Lab has reported that the after-tax (net) income is $360 million. With 200 million shares of common stock outstanding, Bio Lab announced to distribute $150 million of dividends to its shareholders. The stock is now sold for $27 per share. 1 a. Find the earnings per share (EPS) of Bio Lab. 2 marks b. Find the historical price-caminys (PE) ralio of Bio Lab. 2 marks c. Suppose that Bio Lab does not have any outstanding debt. The current stock price reflects the fair value of the Company. What is the market value of Bio Lab before the ex-dividend date? ii. What is the market value of Bio Lab after the ex-dividend date? iii. What is the price per share of Bio Lab after the ex-dividend date? iv. Find the value of investor's wealth who holds 6,000 shares of Bio Lab before the ex-dividend date, Find the dividend income of an investor who holds 6,000 shares of Bio Lab until the ex-dividend date, vi. Find the value of shareholding on the ex-dividend date of an investor who holds 6.000 shares of Bio Lab. 10 marks d. Will it be different for the investor to sell his shares before the ex-dividend date or to hold his shares until the ex-dividend date which allows him to receive dividend? Suppose that the dividend is paid on the ex-dividend date. Explain by referring to your answers in part ( C ). 3 marks Show all your calculations. Sources: Ross, FCE, MiH; Kerk, Corporate Finance Brcaley, PME, Pearson Py. 3 of 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts