Question: Question 5 ( 2 0 marks ) The Solara Division of Meridian Industries forecasts earning N$ 4 . 5 million in annual profit before tax

Question

marks

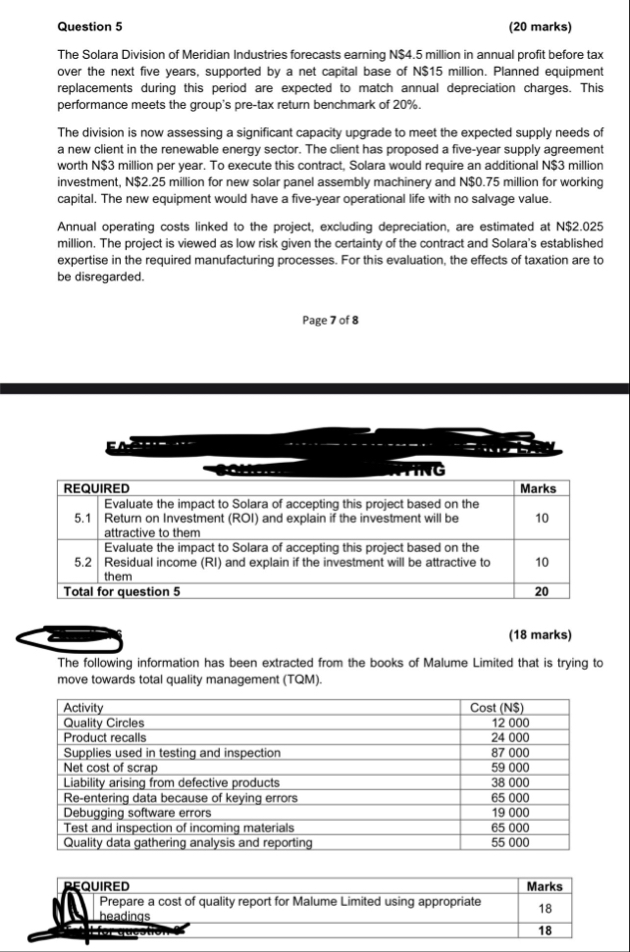

The Solara Division of Meridian Industries forecasts earning N$ million in annual profit before tax over the next five years, supported by a net capital base of N$ million. Planned equipment replacements during this period are expected to match annual depreciation charges. This performance meets the group's pretax return benchmark of

The division is now assessing a significant capacity upgrade to meet the expected supply needs of a new client in the renewable energy sector. The client has proposed a fiveyear supply agreement worth N$ million per year. To execute this contract, Solara would require an additional N$ million investment, N $ million for new solar panel assembly machinery and N $ million for working capital. The new equipment would have a fiveyear operational life with no salvage value.

Annual operating costs linked to the project, excluding depreciation, are estimated at $ million. The project is viewed as low risk given the certainty of the contract and Solara's established expertise in the required manufacturing processes. For this evaluation, the effects of taxation are to be disregarded.

The following information has been extracted from the books of Malume Limited that is trying to move towards total quality management TQM

tableActivityCost N$Quality Circles,Product recalls,Supplies used in testing and inspection,Net cost of scrap,Liability arising from defective products,Reentering data because of keying errors,Debugging software errors,Test and inspection of incoming materials,Quality data gathering analysis and reporting,

tablePGUIREDMarkstablePrepare a cost of quality report for Malume Limited using appropriateheadings

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock