Question: QUESTION 5 ( 2 5 Marks ) Mark and Samantha's son Tyron has recently obtained his driver's license. They believe that it would be a

QUESTION

Marks

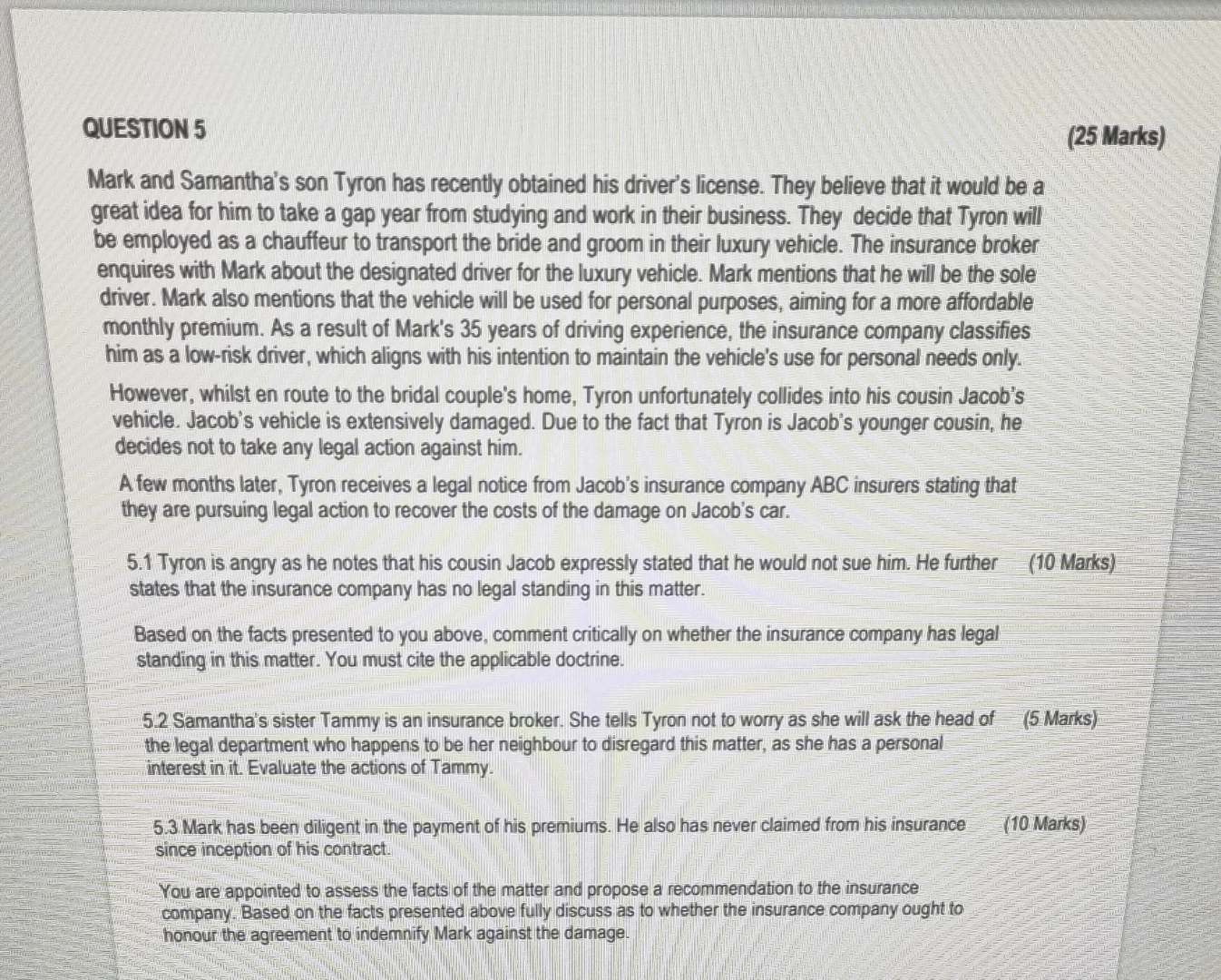

Mark and Samantha's son Tyron has recently obtained his driver's license. They believe that it would be a great idea for him to take a gap year from studying and work in their business. They decide that Tyron will be employed as a chauffeur to transport the bride and groom in their luxury vehicle. The insurance broker enquires with Mark about the designated driver for the luxury vehicle. Mark mentions that he will be the sole driver. Mark also mentions that the vehicle will be used for personal purposes, aiming for a more affordable monthly premium. As a result of Mark's years of driving experience, the insurance company classifies him as a lowrisk driver, which aligns with his intention to maintain the vehicle's use for personal needs only.

However, whilst en route to the bridal couple's home, Tyron unfortunately collides into his cousin Jacob's vehicle. Jacob's vehicle is extensively damaged. Due to the fact that Tyron is Jacob's younger cousin, he decides not to take any legal action against him.

A few months later, Tyron receives a legal notice from Jacob's insurance company ABC insurers stating that they are pursuing legal action to recover the costs of the damage on Jacob's car.

Tyron is angry as he notes that his cousin Jacob expressly stated that he would not sue him. He further

Marks

states that the insurance company has no legal standing in this matter.

Based on the facts presented to you above, comment critically on whether the insurance company has legal standing in this matter. You must cite the applicable doctrine.

Samantha's sister Tammy is an insurance broker. She tells Tyron not to worry as she will ask the head of

Marks

the legal department who happens to be her neighbour to disregard this matter, as she has a personal interest in it Evaluate the actions of Tammy.

Mark has been diligent in the payment of his premiums. He also has never claimed from his insurance

Marks

since inception of his contract.

You are appointed to assess the facts of the matter and propose a recommendation to the insurance company. Based on the facts presented above fully discuss as to whether the insurance company ought to honour the agreement to indemnify Mark against the damage.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock