Question: Question 5 ( 2 points ) Listen The default risk premium: compensates investors for interest rate risk, which is that long - term securities are

Question points

Listen

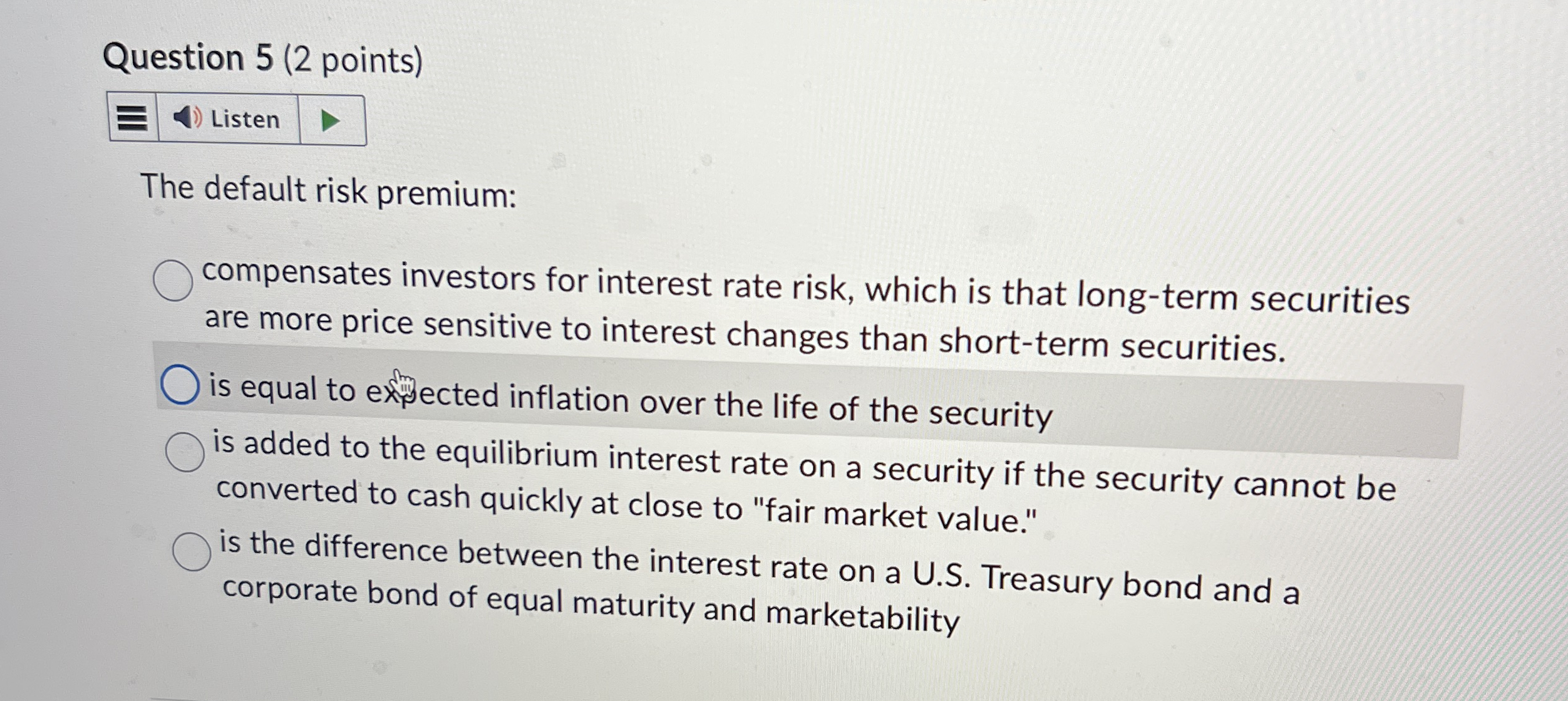

The default risk premium:

compensates investors for interest rate risk, which is that longterm securities are more price sensitive to interest changes than shortterm securities

is equal to eximected inflation over the life of the security

is added to the equilibrium interest rate on a security if the security cannot be converted to cash quickly at close to "fair market value."

is the difference between the interest rate on a US Treasury bond and a corporate bond of equal maturity and marketability

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock