Question: Question 5 (2 points) Marginal Incorporated (MI) has determined that its after-tax cost of debt is 6.0% for the first $134 million in bonds it

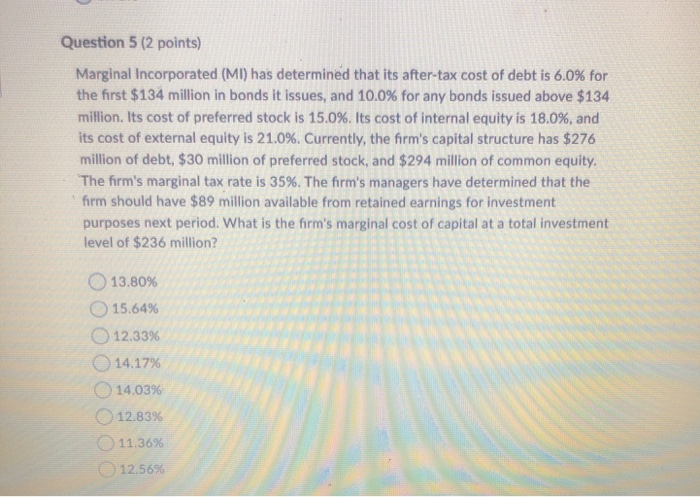

Question 5 (2 points) Marginal Incorporated (MI) has determined that its after-tax cost of debt is 6.0% for the first $134 million in bonds it issues, and 10.0% for any bonds issued above $134 million. Its cost of preferred stock is 15.0%. Its cost of internal equity is 18.0%, and its cost of external equity is 21.0%. Currently, the firm's capital structure has $276 million of debt, $30 million of preferred stock, and $294 million of common equity. The firm's marginal tax rate is 35%. The firm's managers have determined that the form should have $89 million available from retained earnings for investment purposes next period. What is the firm's marginal cost of capital at a total investment level of $236 million? 13.80% 15.64% O 12.33% 14.17% 14.03% 12.83% 11.36% 12.56%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts