Question: Question 5 (2 points) When a governmental entity adopts a basis of accounting other than full accrual and a measurement focus that excludes long-lived assets

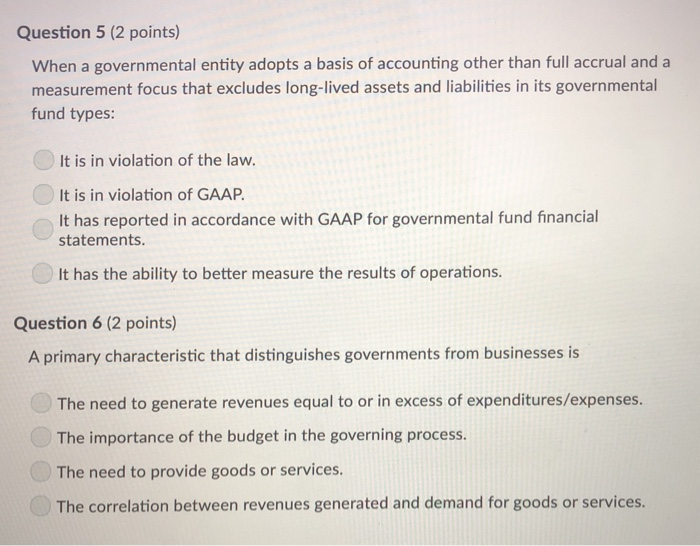

Question 5 (2 points) When a governmental entity adopts a basis of accounting other than full accrual and a measurement focus that excludes long-lived assets and liabilities in its governmental fund types: It is in violation of the law. It is in violation of GAAP. It has reported in accordance with GAAP for governmental fund financial statements. It has the ability to better measure the results of operations. Question 6 (2 points) A primary characteristic that distinguishes governments from businesses is The need to generate revenues equal to or in excess of expenditures/expenses. The importance of the budget in the governing process. The need to provide goods or services. The correlation between revenues generated and demand for goods or services

Step by Step Solution

There are 3 Steps involved in it

Question 5 When a governmental entity adopts a basis of accounting other ... View full answer

Get step-by-step solutions from verified subject matter experts