Question: Question 5 2 pts A company is purchasing a new machine which will cost $130,000 with additional shipping costs of $5,000 and set up and

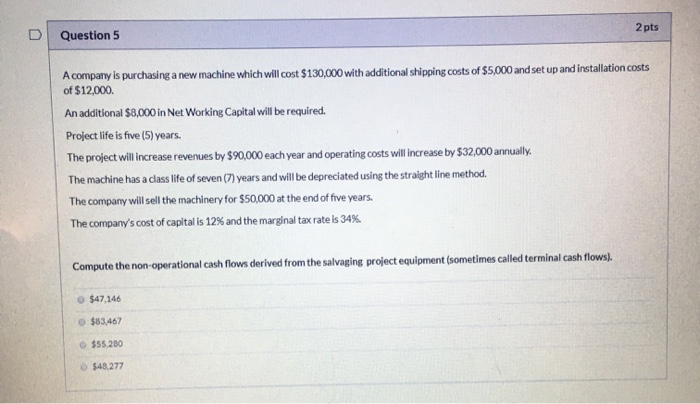

Question 5 2 pts A company is purchasing a new machine which will cost $130,000 with additional shipping costs of $5,000 and set up and installation costs of $12,000 An additional $8,000 in Net Working Capital will be required. Project life is five (5) years. The project will increase revenues by $90,000 each year and operating costs will increase by $32,000 annually. The machine has a class life of seven (7) years and will be depreciated using the straight line method. The company will sell the machinery for $50,000 at the end of five years. The company's cost of capital is 12% and the marginal tax rate is 34%. Compute the non-operational cash flows derived from the salvaging project equipment (sometimes called terminal cash flows). $47,146 $83,467 555200 $48.277

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts