Question: Question 5 2 pts A declining Return on Equity (ROE) for a majority of the insurers in the industry could most likely be a sign

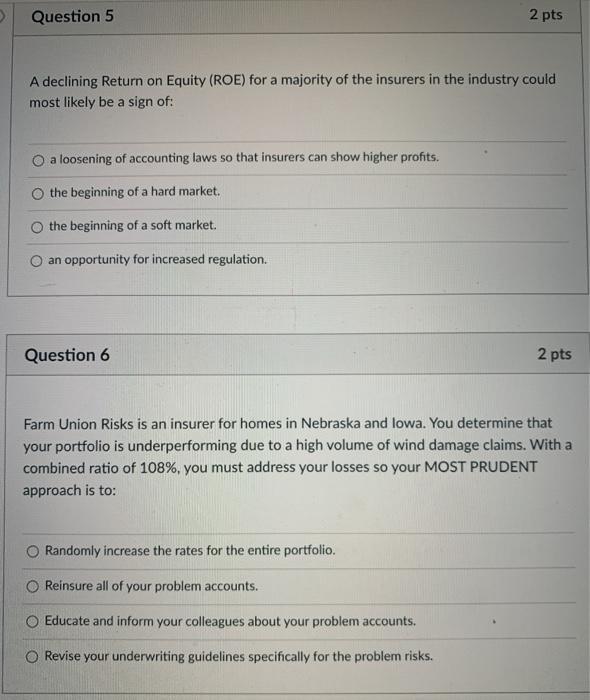

Question 5 2 pts A declining Return on Equity (ROE) for a majority of the insurers in the industry could most likely be a sign of: a loosening of accounting laws so that insurers can show higher profits. the beginning of a hard market. the beginning of a soft market. an opportunity for increased regulation Question 6 2 pts Farm Union Risks is an insurer for homes in Nebraska and lowa. You determine that your portfolio is underperforming due to a high volume of wind damage claims. With a combined ratio of 108%, you must address your losses so your MOST PRUDENT approach is to: Randomly increase the rates for the entire portfolio. Reinsure all of your problem accounts. Educate and inform your colleagues about your problem accounts, O Revise your underwriting guidelines specifically for the problem risks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts