Question: Question 5 (20) CASE STUDY BIGGER IS NOT ALWAYS BETTER: THE STORY OF TASTE HOLDING Introduction Taste Holdings had its origins in the year 2000

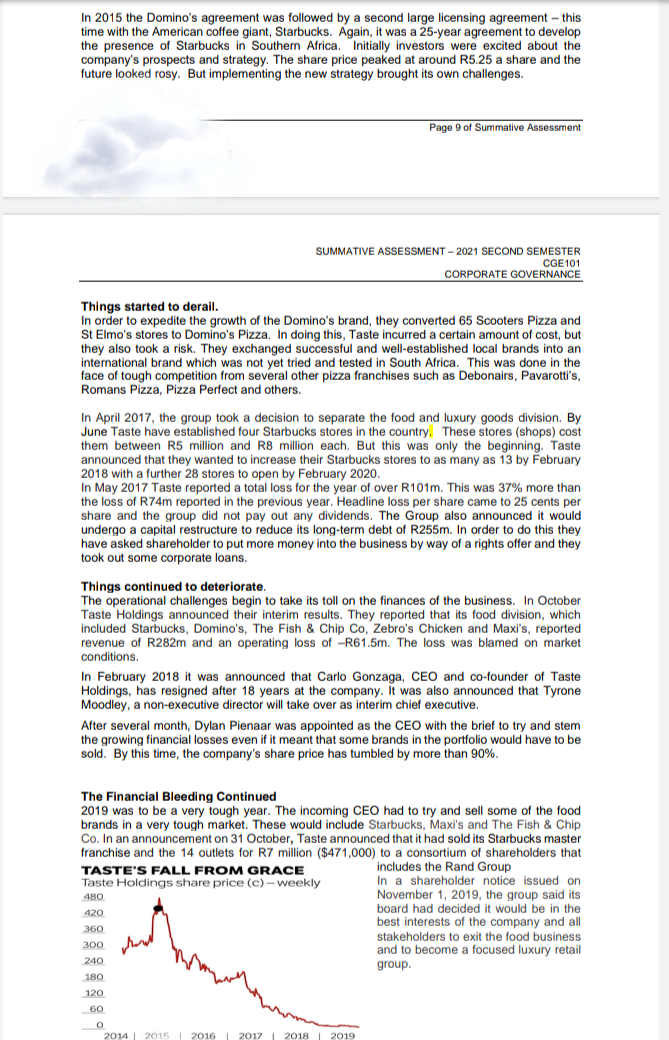

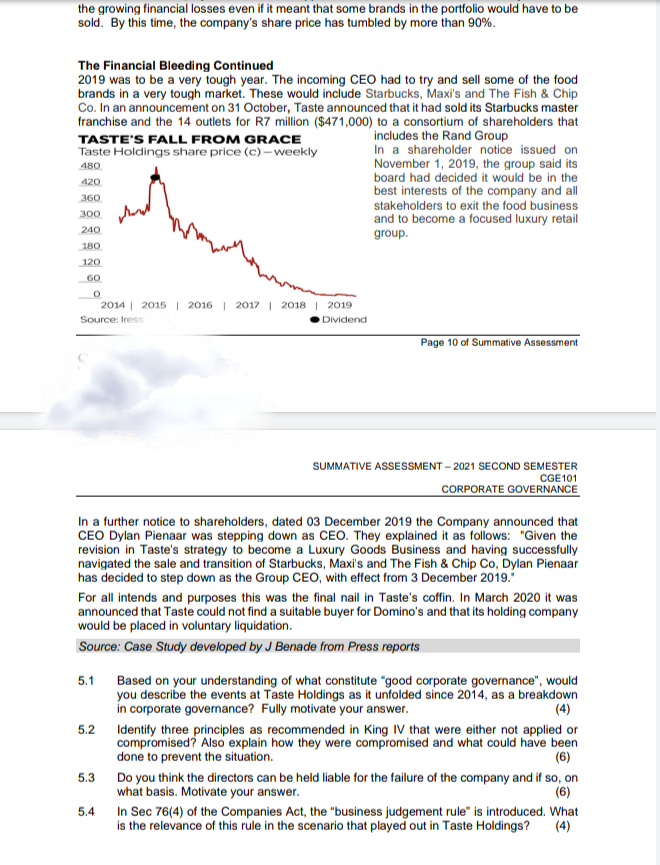

Question 5 (20) CASE STUDY BIGGER IS NOT ALWAYS BETTER: THE STORY OF TASTE HOLDING Introduction Taste Holdings had its origins in the year 2000 when the first Scooters Pizza opened its doors in Durban. Within five years it had spread to Gauteng and the Western Cape and it also bought a share in the Maxi's restaurant group. The business model was a mixed one where the group owned some of its food outlets itself whilst others were owned by franchise holders. In 2006 Taste listed on the Alt-X, (the junior board of the Johannesburg Stock Exchange). It also bought into some luxury goods division, which would gradually become a second division, separate from the food division. Taste continued to grow at a rapid pace. They acquired the BJ's restaurants and then also St Elmo's, a successful Pizza Restaurant Chain in 2011, Taste Holdings moved to the main Board of the JSE and in 2012 they acquired the Fish & Chip Company During this phase they also decided to exploit the potential benefits of vertical integration, which mean that they develop their own service company under the name Buon Gusto Food Services. This company was to render services and products to their approximately 600 outlets and restaurants Page 8 of Summative Assessment SUMMATIVE ASSESSMENT - 2021 SECOND SEMESTER CGE 101 CORPORATE GOVERNANCE A Tale of Exceptional Growth By the year 2014 the company's business model was already well developed. During this year they also acquired Zebro's Chicken a 15-year-old chicken brand. In their 2014 Annual Report, Taste Holdings, published a table that shows that the group had grown to more than 600 stores/restaurants and that their growth in headline earnings per share exceeded 20% per annum. Debt was under control and the company was beginning to attract the attention of corporate investors. Taste was also recognised by its peers in its industry. It has won various awards for being one of the best franchises in South Africa. In 2014 Taste won the IAS Award for best reporting and communications. Their CEO, Carlo Gonzaga was also inducted into the FASA Hall of Fame. Corporate Governance at Taste Holdings In the 2014 Annual Report of Taste Holdings, the following statement is made: "Board members are accountable to shareholders, and they owe duty of care and diligence to the company. They act in the best interests of the company and its shareholders. To fulfil their role, board members participate in rigorous and constructive debate and discussion." The Company Report also indicated that they were compliant with King III. According to the 2014 Annual Report, the company was guided by an all-male Board which was composed of four (4) Executive Directors and seven (7) Non-executive Directors. The Chairman of the Board Ramsay Daly has been serving on the Board since 2000 when the company was started. The Board had two sub-committees: -An Audit and Risk Committee, and -A Social, Ethics and Remuneration Committee. The Group CEO, Carlo Gonzaga was the founder and co-owner of Scooters Pizza, the company that grew to become Taste Holdings. As the company grew, he retained a significant shareholding in Taste Holdings. As the Group Executive, his responsibility included the strategic direction of the company, and he chaired the Group Executive Committee. In 2015 the Domino's agreement was followed by a second large licensing agreement - this time with the American coffee giant, Starbucks. Again, it was a 25-year agreement to develop the presence of Starbucks in Southern Africa. Initially investors were excited about the company's prospects and strategy. The share price peaked at around R5.25 a share and the future looked rosy. But implementing the new strategy brought its own challenges. Page 9 of Summative Assessment SUMMATIVE ASSESSMENT - 2021 SECOND SEMESTER CGE 101 CORPORATE GOVERNANCE Things started to derail. In order to expedite the growth of the Domino's brand, they converted 65 Scooters Pizza and St Elmo's stores to Domino's Pizza. In doing this, Taste incurred a certain amount of cost, but they also took a risk. They exchanged successful and well-established local brands into an international brand which was not yet tried and tested in South Africa. This was done in the face of tough competition from several other pizza franchises such as Debonairs, Pavarotti's, Romans Pizza, Pizza Perfect and others. In April 2017, the group took a decision to separate the food and luxury goods division. By June Taste have established four Starbucks stores in the country. These stores (shops) cost them between R5 million and R8 million each. But this was only the beginning. Taste announced that they wanted to increase their Starbucks stores to as many as 13 by February 2018 with a further 28 stores to open by February 2020. In May 2017 Taste reported a total loss for the year of over R101m. This was 37% more than the loss of R74m reported in the previous year. Headline loss per share came to 25 cents per share and the group did not pay out any dividends. The Group also announced it would undergo a capital restructure to reduce its long-term debt of R255m. In order to do this they have asked shareholder to put more money into the business by way of a rights offer and they took out some corporate loans. Things continued to deteriorate. The operational challenges begin to take its toll on the finances of the business. In October Taste Holdings announced their interim results. They reported that its food division, which included Starbucks, Domino's, The Fish & Chip Co, Zebro's Chicken and Maxi's, reported revenue of R282m and an operating loss of -R61.5m. The loss was blamed on market conditions. In February 2018 it was announced that Carlo Gonzaga, CEO and co-founder of Taste Holdings, has resigned after 18 years at the company. It was also announced that Tyrone Moodley, a non-executive director will take over as interim chief executive. After several month, Dylan Pienaar was appointed as the CEO with the brief to try and stem the growing financial losses even if it meant that some brands in the portfolio would have to be sold. By this time, the company's share price has tumbled by more than 90%. The Financial Bleeding Continued 2019 was to be a very tough year. The incoming CEO had to try and sell some of the food brands in a very tough market. These would include Starbucks, Maxi's and The Fish & Chip Co. In an announcement on 31 October, Taste announced that it had sold its Starbucks master franchise and the 14 outlets for R7 million ($471,000) to a consortium of shareholders that TASTE'S FALL FROM GRACE includes the Rand Group Taste Holdings share price (c)-weekly In a shareholder notice issued on 480 November 1, 2019, the group said its 420 board had decided it would be in the best interests of the company and all stakeholders to exit the food business and to become a focused luxury retail group. 180 120 60 0 2014 2015 2016 2017 2018 2019 360 360 200 300 20 240 the growing financial losses even if it meant that some brands in the portfolio would have to be sold. By this time, the company's share price has tumbled by more than 90%. The Financial Bleeding Continued 2019 was to be a very tough year. The incoming CEO had to try and sell some of the food brands in a very tough market. These would include Starbucks, Maxi's and The Fish & Chip Co. In an announcement on 31 October, Taste announced that it had sold its Starbucks master franchise and the 14 outlets for R7 million ($471,000) to a consortium of shareholders that TASTE'S FALL FROM GRACE includes the Rand Group Taste Holdings share price (c) - weekly In a shareholder notice issued on November 1, 2019, the group said its board had decided it would be in the best interests of the company and all 360 stakeholders to exit the food business and to become a focused luxury retail group. 180 480 420 300 240 120 60 O 2014 2015 2016 2017 2018 2019 Source: tress Dividend Page 10 of Summative Assessment SUMMATIVE ASSESSMENT -2021 SECOND SEMESTER CGE 101 CORPORATE GOVERNANCE In a further notice to shareholders, dated 03 December 2019 the Company announced that CEO Dylan Pienaar was stepping down as CEO. They explained it as follows: "Given the revision in Taste's strategy to become a Luxury Goods Business and having successfully navigated the sale and transition of Starbucks, Maxi's and The Fish & Chip Co, Dylan Pienaar has decided to step down as the Group CEO, with effect from 3 December 2019. For all intends and purposes this was the final nail in Taste's coffin. In March 2020 it was announced that Taste could not find a suitable buyer for Domino's and that its holding company would be placed in voluntary liquidation. Source: Case Study developed by J Benade from Press reports 5.1 5.2 Based on your understanding of what constitute "good corporate governance", would you describe the events at Taste Holdings as it unfolded since 2014, as a breakdown in corporate governance? Fully motivate your answer. (4) Identify three principles as recommended in King IV that were either not applied or compromised? Also explain how they were compromised and what could have been done to prevent the situation. (6) Do you think the directors can be held liable for the failure of the company and if so, on what basis. Motivate your answer. (6) In Sec 76(4) of the Companies Act, the "business judgement rule" is introduced. What is the relevance of this rule in the scenario that played out in Taste Holdings? 5.3 5.4 (4)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock