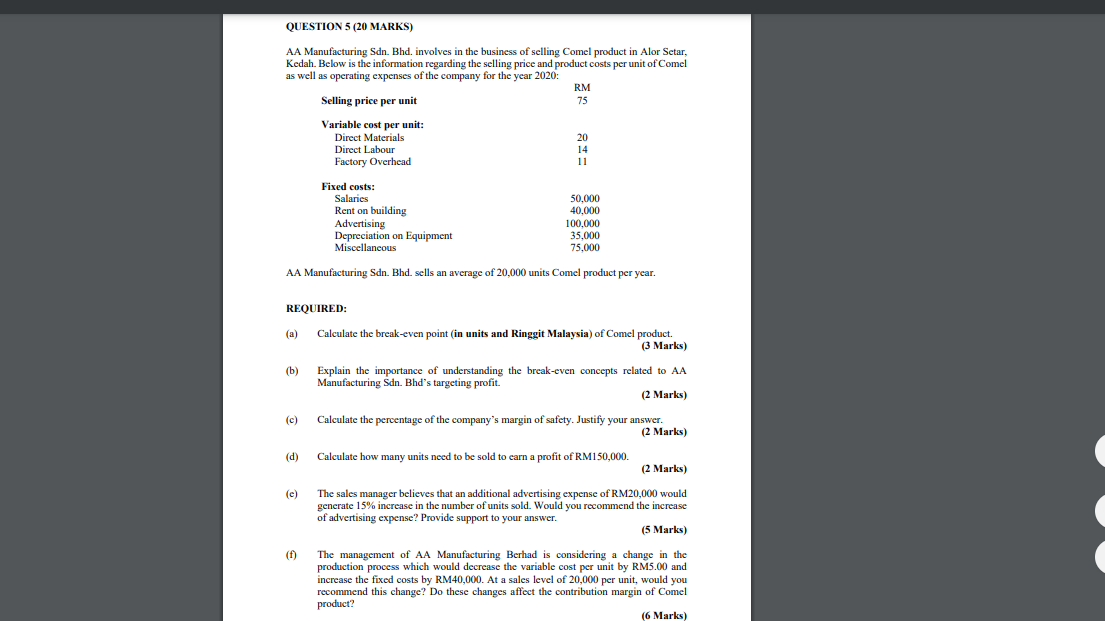

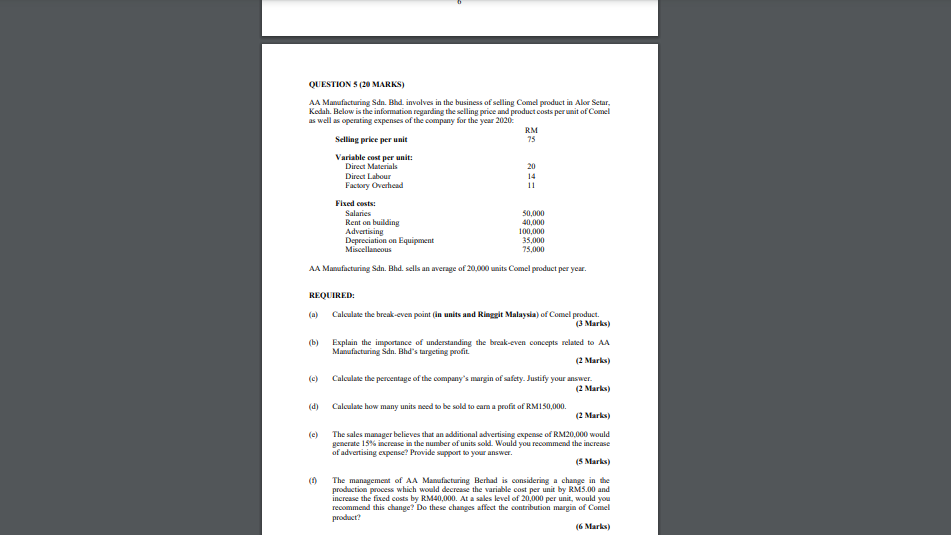

Question: QUESTION 5 (20 MARKS) AA Manufacturing Sdn. Bhd. involves in the business of selling Comel product in Alor Setar, Kedah. Below is the information regarding

QUESTION 5 (20 MARKS) AA Manufacturing Sdn. Bhd. involves in the business of selling Comel product in Alor Setar, Kedah. Below is the information regarding the selling price and product costs per unit of Comel as well as operating expenses of the company for the year 2020: RM Selling price per unit 75 Variable cost per unit: Direct Materials 20 Direct Labour 14 Factory Overhead 11 Fixed costs: Salaries Rent on building Advertising Depreciation on Equipment Miscellaneous 50,000 40,000 100,000 35,000 75,000 AA Manufacturing Sdn. Bhd. sells an average of 20,000 units Comel product per year. REQUIRED: (a) Calculate the break-even point in units and Ringgit Malaysia) of Comel product. (3 Marks) (b) Explain the importance of understanding the break-even concepts related to AA Manufacturing Sdn. Bhd's targeting profit. (2 Marks) (c) Calculate the percentage of the company's margin of safety. Justify your answer. (2 Marks) (d) Calculate how many units need to be sold to earn a profit of RM150,000. (2 Marks) The sales manager believes that an additional advertising expense of RM20,000 would generate 15% increase in the number of units sold. Would you recommend the increase of advertising expense? Provide support to your answer. (5 Marks) (f) The management of AA Manufacturing Berhad is considering a change in the production process which would decrease the variable cost per unit by RM5.00 and increase the fixed costs by RM40,000. At a sales level of 20,000 per unit, would you recommend this change? Do these changes affect the contribution margin of Comel product? (6 Marks) QUESTIONS (20 MARKS) AA Manufacturing Sdn. Bhd. involves in the business of selling Comel product in Alor Setar, Kedah. Below is the information regarding the selling price and product costs per unit of Comel as well as operating expenses of the company for the year 2020 RM Selling price per unit 75 Variable cost per unit: Direct Materials 20 Direct Labour Factory Overhead Fixed costs: Salaries Rent on building Advertising Depreciation on Equipment Miscellaneous 50,000 40,000 100 35,000 75,000 AA Manufacturing Sdn. Bhd. sells an average of 20,000 units Comel product per year. REQUIRED: Calculate the break-even point (in units and Ringgit Malaysia) of Comel product. (3 Marks) (b) Explain the importance of understanding the break-even concepts related to AA Manufacturing Sdn. Bhd's targeting profit (2 Marks) (c) Calculate the percentage of the company's margin of safety. Justify your answer. (2 Marks) (d) Calculate how many units need to be sold to carn a profit of RM150,000. (2 Marks) The sales manager believes that an additional advertising expense of RM20,000 would generate 15% increase in the number of units sold. Would you recommend the increase of advertising expense! Provide support to your answer. (5 Marks) (1) The management of AA Manufacturing Berhad is considering a change in the production process which would decrease the variable cost per unit by RM5.00 and increase the fixed costs by RM40,000. At a sales level of 20,000 per unit, would you recommend this change? Do these changes affect the contribution margin of Comel product? (6 Marks) c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts