Question: Question 5 (20 Marks) As a new manager, you are requested to evaluate two projects that are going to be undertaken by your company. The

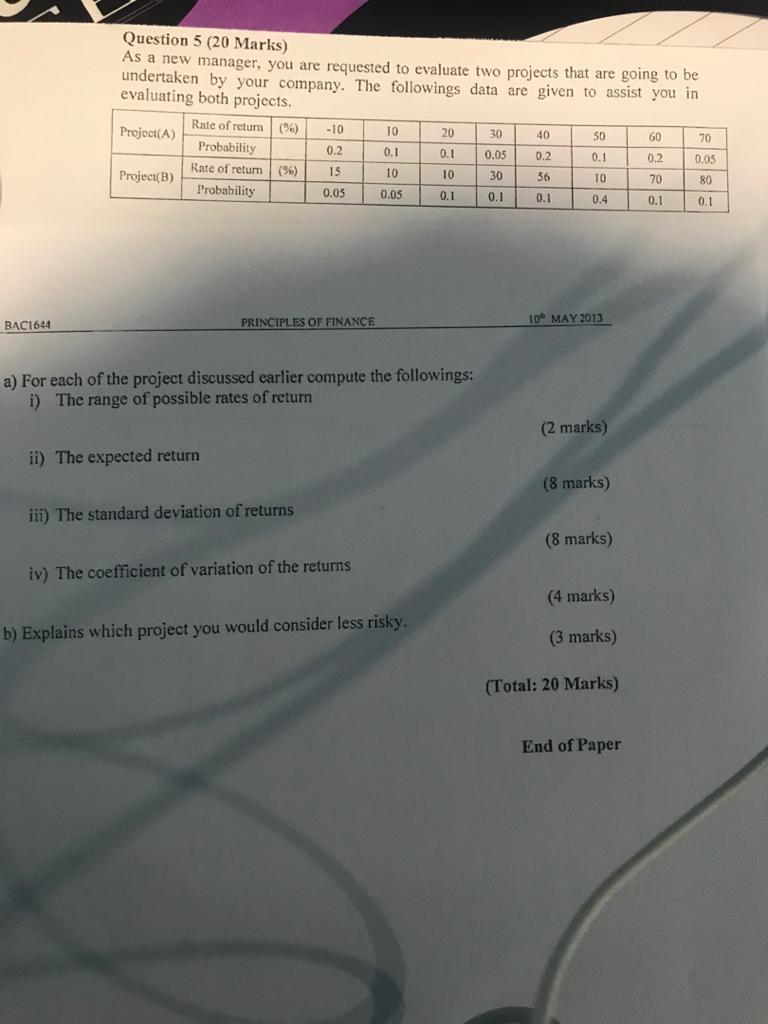

Question 5 (20 Marks) As a new manager, you are requested to evaluate two projects that are going to be undertaken by your company. The followings data are given to assist you in evaluating both projects. Rate of return Project(A) (%) -10 10 20 50 60 Probability 0.1 0.1 0.05 Rate of retur (%) 15 10 10 Project(B) 30 56 Probability 0.05 0.05 0.1 0.1 0. 30 40 70 0.2 0.2 0.! 0.2 0.05 10 70 80 0.1 0.1 0.4 BACI644 10 MAY 2013 PRINCIPLES OF FINANCE a) For each of the project discussed earlier compute the followings: i) The range of possible rates of return (2 marks) ii) The expected return (8 marks) iii) The standard deviation of returns (8 marks) iv) The coefficient of variation of the returns (4 marks) b) Explains which project you would consider less risky. (3 marks) (Total: 20 Marks) End of Paper

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts