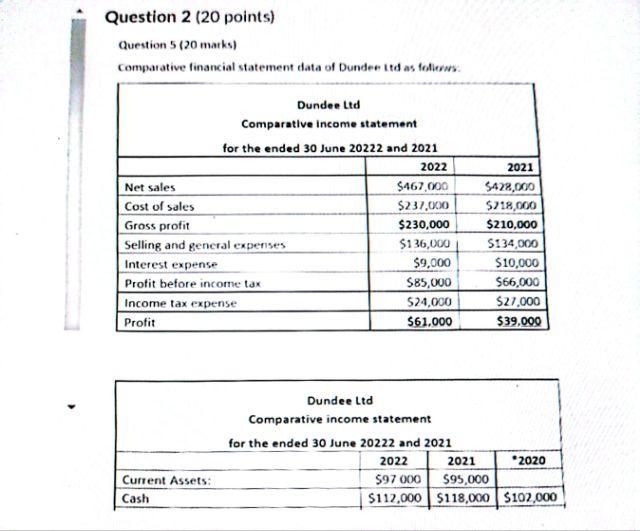

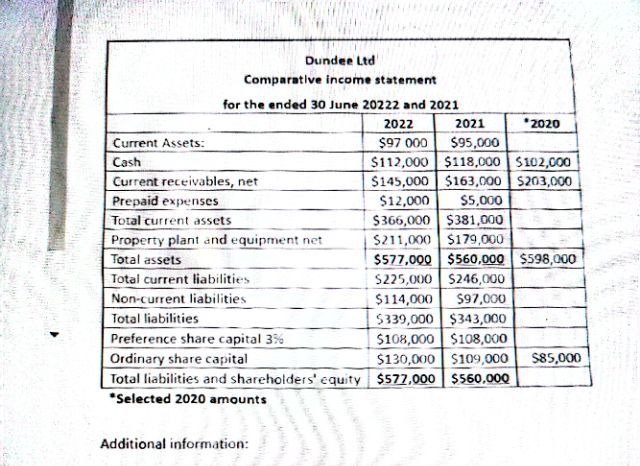

Question: Question 5 (20 marks) Comparative financial statement data of Dundee ttd as fedierws. Additional information: 1. Market price of Dundee's ordinary share: $86.50 at 31

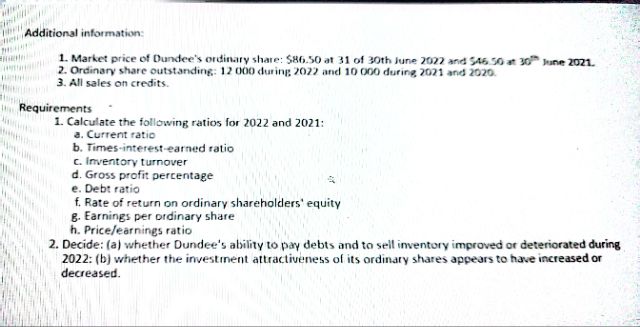

Question 5 (20 marks) Comparative financial statement data of Dundee ttd as fedierws. Additional information: 1. Market price of Dundee's ordinary share: $86.50 at 31 of 30 th june 2022 and 546.50 at 307 june 2021. 2. Ordinary share outstanding: 12000 during: 7027 and 10 000 during 2021 and 2020 . 3. All sales on credits. equirements 1. Calculate the following ratios for 2022 and 2021 : a. Current ratio b. Times-interest-earned ratio c. Imventory turnover d. Gross profit percentage e. Debt ratio f. Rate of return on ordinary shareholders' equity B. Earnings per ordinary share h. Pricelearnings ratio 2. Decide: (a) whether Dundee's ability to pay debts and to sell imventory improved or deteriorated during 2022: (b) whether the investinent attractiveness of its ordinary shares appears to have increased or decreased. Additional information: Question 5 (20 marks) Comparative financial statement data of Dundee ttd as fedierws. Additional information: 1. Market price of Dundee's ordinary share: $86.50 at 31 of 30 th june 2022 and 546.50 at 307 june 2021. 2. Ordinary share outstanding: 12000 during: 7027 and 10 000 during 2021 and 2020 . 3. All sales on credits. equirements 1. Calculate the following ratios for 2022 and 2021 : a. Current ratio b. Times-interest-earned ratio c. Imventory turnover d. Gross profit percentage e. Debt ratio f. Rate of return on ordinary shareholders' equity B. Earnings per ordinary share h. Pricelearnings ratio 2. Decide: (a) whether Dundee's ability to pay debts and to sell imventory improved or deteriorated during 2022: (b) whether the investinent attractiveness of its ordinary shares appears to have increased or decreased. Additional information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts