Question: Question 5 (20 marks) CPU, Inc., has decided to issue a perpetual bond. The bond has a face value of $1,000 and makes 10% annual

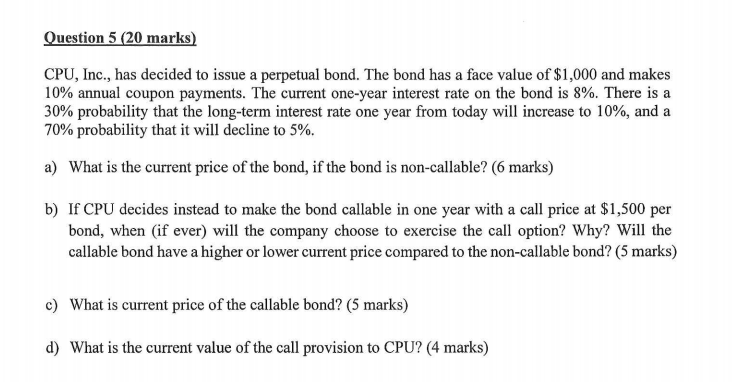

Question 5 (20 marks) CPU, Inc., has decided to issue a perpetual bond. The bond has a face value of $1,000 and makes 10% annual coupon payments. The current one-year interest rate on the bond is 8%. There is a 30% probability that the long-term interest rate one year from today will increase to 10%, and a 70% probability that it will decline to 5%. a) What is the current price of the bond, if the bond is non-callable? (6 marks) b) If CPU decides instead to make the bond callable in one year with a call price at $1,500 per bond, when (if ever) will the company choose to exercise the call option? Why? Will the callable bond have a higher or lower current price compared to the non-callable bond? (5 marks) c) What is current price of the callable bond? (5 marks) d) What is the current value of the call provision to CPU? (4 marks) Question 5 (20 marks) CPU, Inc., has decided to issue a perpetual bond. The bond has a face value of $1,000 and makes 10% annual coupon payments. The current one-year interest rate on the bond is 8%. There is a 30% probability that the long-term interest rate one year from today will increase to 10%, and a 70% probability that it will decline to 5%. a) What is the current price of the bond, if the bond is non-callable? (6 marks) b) If CPU decides instead to make the bond callable in one year with a call price at $1,500 per bond, when (if ever) will the company choose to exercise the call option? Why? Will the callable bond have a higher or lower current price compared to the non-callable bond? (5 marks) c) What is current price of the callable bond? (5 marks) d) What is the current value of the call provision to CPU? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts