Question: Question 5 (20 points): Your company is looking at purchasing a new front-end loader and has narrowed the choice down to four loaders. The purchase

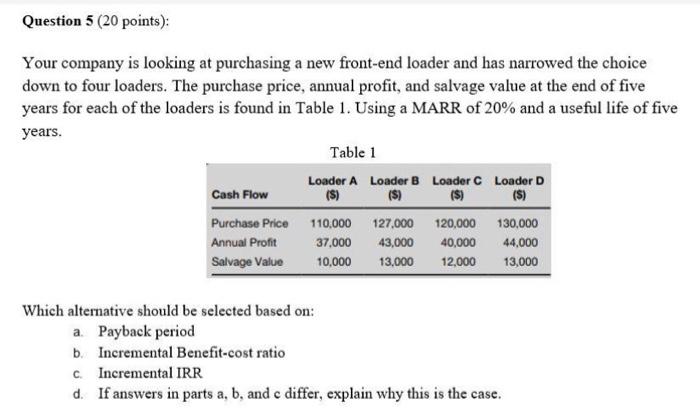

Question 5 (20 points): Your company is looking at purchasing a new front-end loader and has narrowed the choice down to four loaders. The purchase price, annual profit, and salvage value at the end of five years for each of the loaders is found in Table 1. Using a MARR of 20% and a useful life of five years. Table 1 Loader A Loader B Loader C Loader D Cash Flow () ($) ($) ($) Purchase Price 110,000 127,000 120,000 130,000 Annual Profit 37,000 43,000 40,000 44.000 Salvage Value 10,000 13,000 12,000 13,000 Which alternative should be selected based on: a Payback period b. Incremental Benefit-cost ratio C. Incremental IRR d. If answers in parts a, b, and c differ, explain why this is the case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts