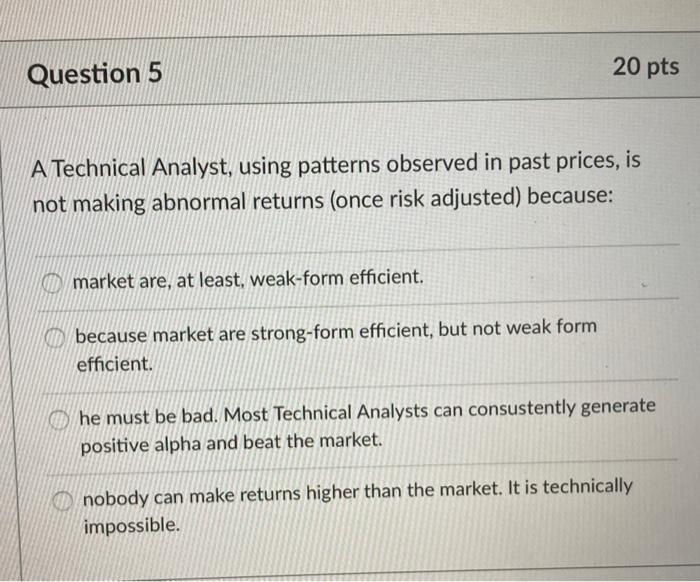

Question: Question 5 20 pts A Technical Analyst, using patterns observed in past prices, is not making abnormal returns (once risk adjusted) because: market are, at

Question 5 20 pts A Technical Analyst, using patterns observed in past prices, is not making abnormal returns (once risk adjusted) because: market are, at least, weak-form efficient. because market are strong-form efficient, but not weak form efficient. he must be bad. Most Technical Analysts can consustently generate positive alpha and beat the market. nobody can make returns higher than the market. It is technically impossible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts