Question: Question #5: 25 points The adjusted trial balance shown below is for Austin Pest Control Company at the end of its current operating year

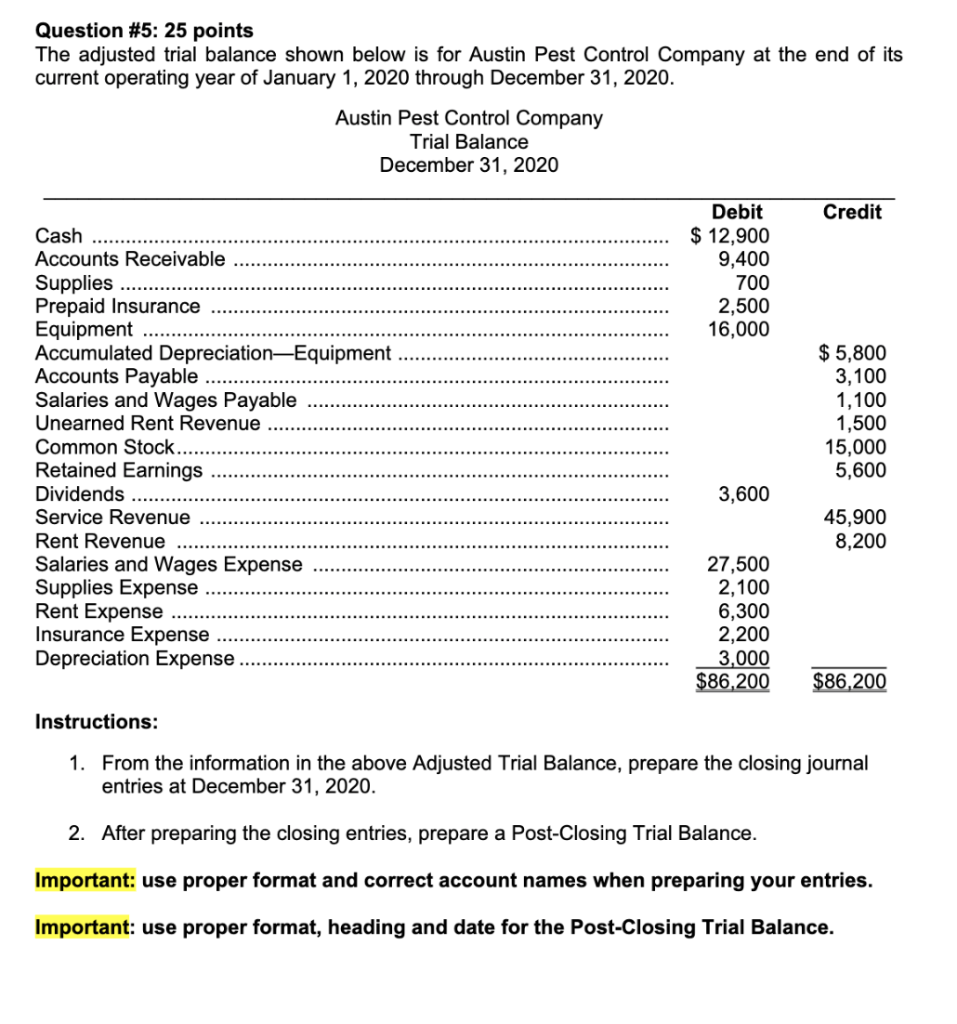

Question #5: 25 points The adjusted trial balance shown below is for Austin Pest Control Company at the end of its current operating year of January 1, 2020 through December 31, 2020. Austin Pest Control Company Trial Balance December 31, 2020 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Unearned Rent Revenue Common Stock.. Retained Earnings Dividends Service Revenue Rent Revenue Salaries and Wages Expense Supplies Expense Rent Expense Insurance Expense Depreciation Expense Instructions: Debit Credit $ 12,900 9,400 700 2,500 16,000 $5,800 3,100 1,100 1,500 15,000 5,600 3,600 45,900 8,200 27,500 2,100 6,300 2,200 3,000 $86,200 $86,200 1. From the information in the above Adjusted Trial Balance, prepare the closing journal entries at December 31, 2020. 2. After preparing the closing entries, prepare a Post-Closing Trial Balance. Important: use proper format and correct account names when preparing your entries. Important: use proper format, heading and date for the Post-Closing Trial Balance.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts