Question: Question 5 (25 points) True or false? First state your answer and then briefly explain it. a) Since current stock price is the sum of

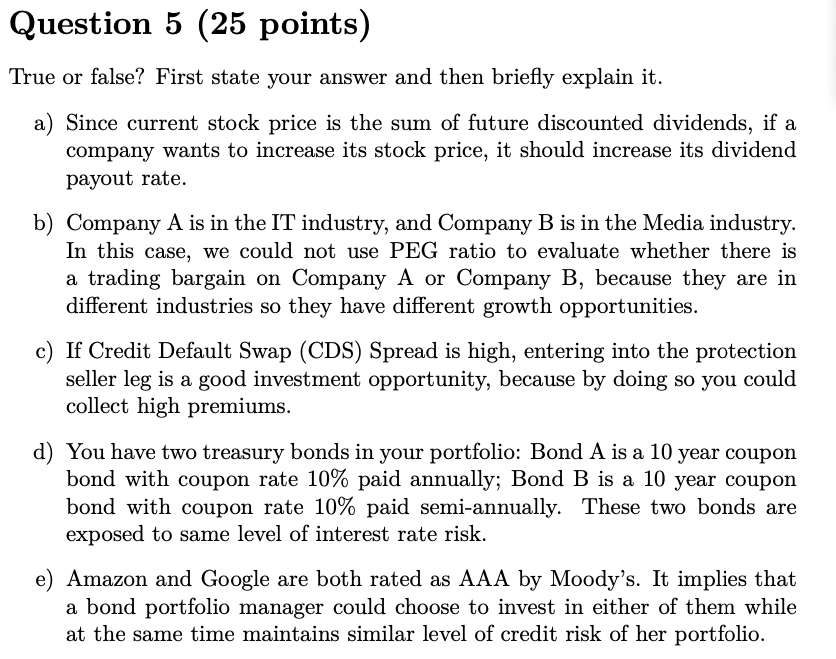

Question 5 (25 points) True or false? First state your answer and then briefly explain it. a) Since current stock price is the sum of future discounted dividends, if a company wants to increase its stock price, it should increase its dividend payout rate. b) Company A is in the IT industry, and Company B is in the Media industry. In this case, we could not use PEG ratio to evaluate whether there is a trading bargain on Company A or Company B, because they are in different industries so they have different growth opportunities. c) If Credit Default Swap (CDS) Spread is high, entering into the protection seller leg is a good investment opportunity, because by doing so you could collect high premiums. d) You have two treasury bonds in your portfolio: Bond A is a 10 year coupon bond with coupon rate 10% paid annually; Bond B is a 10 year coupon bond with coupon rate 10% paid semi-annually. These two bonds are exposed to same level of interest rate risk. e) Amazon and Google are both rated as AAA by Moody's. It implies that a bond portfolio manager could choose to invest in either of them while at the same time maintains similar level of credit risk of her portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts