Question: QUESTION 5 (27 marks) Shoe Haven (Pty) Ltd is a retail store that specialises in footwear and related accessories. The company's current financial year ended

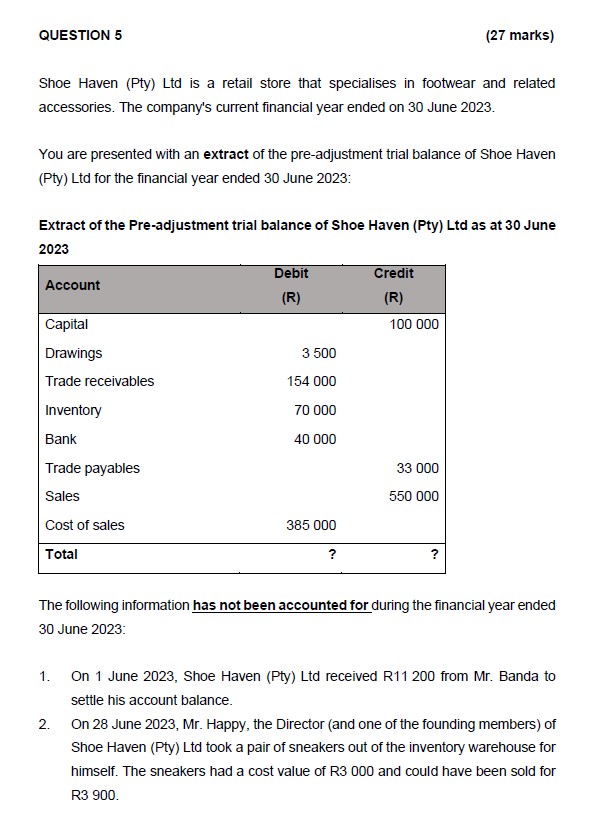

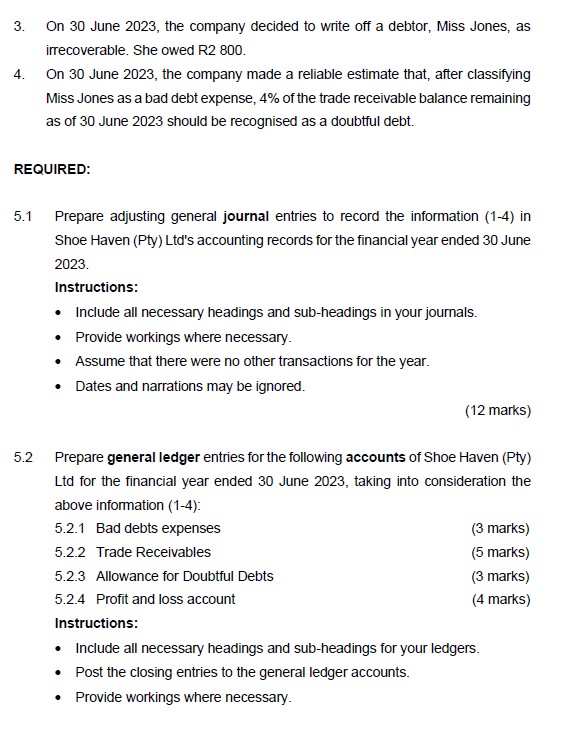

QUESTION 5 (27 marks) Shoe Haven (Pty) Ltd is a retail store that specialises in footwear and related accessories. The company's current financial year ended on 30 June 2023 You are presented with an extract of the pre-adjustment trial balance of Shoe Haven (Pty) Ltd for the financial year ended 30 June 2023: Extract of the Pre-adjustment trial balance of Shoe Haven (Pty) Ltd as at 30 June 2023 The following information has not been accounted for during the financial year ended 30 June 2023: 1. On 1 June 2023, Shoe Haven (Pty) Ltd received R11 200 from Mr. Banda to settle his account balance. 2. On 28 June 2023, Mr. Happy, the Director (and one of the founding members) of Shoe Haven (Pty) Ltd took a pair of sneakers out of the inventory warehouse for himself. The sneakers had a cost value of R3 000 and could have been sold for R3 900. 3. On 30 June 2023 , the company decided to write off a debtor, Miss Jones, as irrecoverable. She owed R2 800. 4. On 30 June 2023 , the company made a reliable estimate that, after classifying Miss Jones as a bad debt expense, \4 of the trade receivable balance remaining as of 30 June 2023 should be recognised as a doubtful debt. REQUIRED: 5.1 Prepare adjusting general journal entries to record the information (1-4) in Shoe Haven (Pty) Ltd's accounting records for the financial year ended 30 June 2023. Instructions: - Include all necessary headings and sub-headings in your journals. - Provide workings where necessary. - Assume that there were no other transactions for the year. - Dates and narrations may be ignored. (12 marks) 5.2 Prepare general ledger entries for the following accounts of Shoe Haven (Pty) Ltd for the financial year ended 30 June 2023, taking into consideration the above information (1-4): 5.2.1 Bad debts expenses (3 marks) 5.2.2 Trade Receivables (5 marks) 5.2.3 Allowance for Doubtful Debts (3 marks) 5.2.4 Profit and loss account (4 marks) Instructions: - Include all necessary headings and sub-headings for your ledgers. - Post the closing entries to the general ledger accounts. - Provide workings where necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts