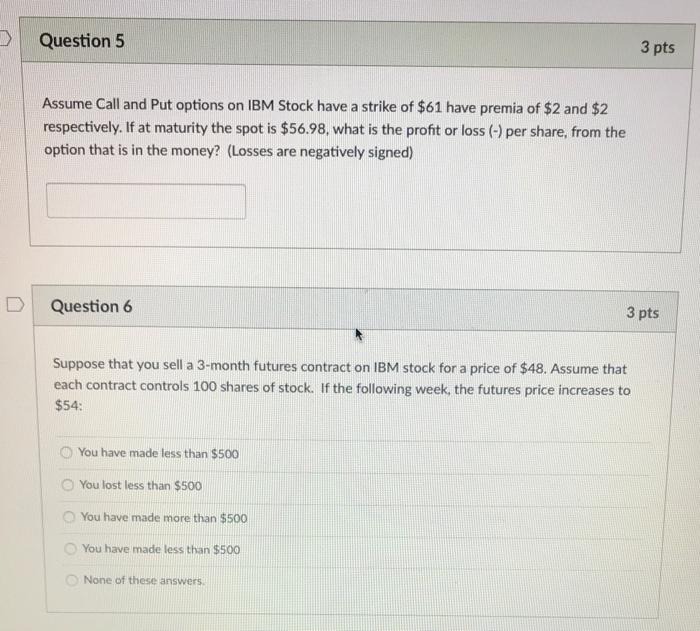

Question: > Question 5 3 pts Assume Call and Put options on IBM Stock have a strike of $61 have premia of $2 and $2 respectively.

> Question 5 3 pts Assume Call and Put options on IBM Stock have a strike of $61 have premia of $2 and $2 respectively. If at maturity the spot is $56.98, what is the profit or loss (-) per share, from the option that is in the money? (Losses are negatively signed) Question 6 3 pts Suppose that you sell a 3-month futures contract on IBM stock for a price of $48. Assume that each contract controls 100 shares of stock. If the following week, the futures price increases to $54: You have made less than $500 You lost less than $500 You have made more than $500 You have made less than $500 None of these answers

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock