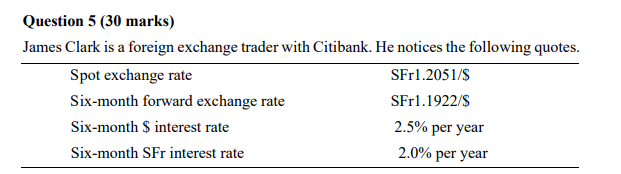

Question: Question 5 (30 marks) James Clark is a foreign exchange trader with Citibank. He notices the following quotes. Spot exchange rate SFr1.2051/$ Six-month forward exchange

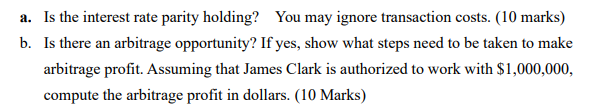

Question 5 (30 marks) James Clark is a foreign exchange trader with Citibank. He notices the following quotes. Spot exchange rate SFr1.2051/$ Six-month forward exchange rate SFrl.1922/$ Six-month $ interest rate 2.5% per year Six-month SFr interest rate 2.0% per year a. Is the interest rate parity holding? You may ignore transaction costs. (10 marks) b. Is there an arbitrage opportunity? If yes, show what steps need to be taken to make arbitrage profit. Assuming that James Clark is authorized to work with $1,000,000, compute the arbitrage profit in dollars. (10 Marks) c. Explain how the IRP will be restored as a result of covered arbitrage activities. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts