Question: Question 5. (30 points) Carlyle & Co. is evaluating a buyout of the division of a publicly traded company. The LBO deal will be financed

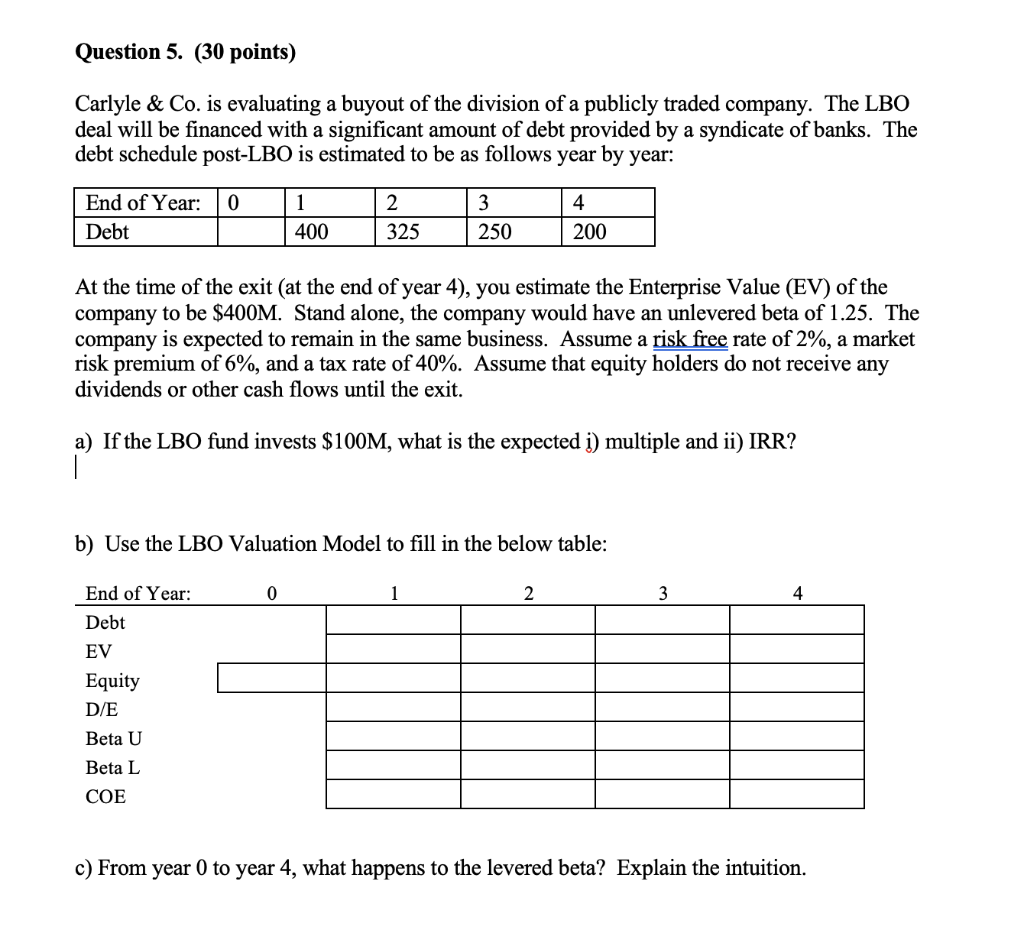

Question 5. (30 points) Carlyle & Co. is evaluating a buyout of the division of a publicly traded company. The LBO deal will be financed with a significant amount of debt provided by a syndicate of banks. The debt schedule post-LBO is estimated to be as follows year by year: 0 1 End of Year: Debt 2. 325 3 250 4 200 400 At the time of the exit (at the end of year 4), you estimate the Enterprise Value (EV) of the company to be $400M. Stand alone, the company would have an unlevered beta of 1.25. The company is expected to remain in the same business. Assume a risk free rate of 2%, a market risk premium of 6%, and a tax rate of 40%. Assume that equity holders do not receive any dividends or other cash flows until the exit. a) If the LBO fund invests $100M, what is the expected i) multiple and ii) IRR? | b) Use the LBO Valuation Model to fill in the below table: 0 1 2 3 4 End of Year: Debt EV Equity D/E Beta U Beta L COE c) From year 0 to year 4, what happens to the levered beta? Explain the intuition. Question 5. (30 points) Carlyle & Co. is evaluating a buyout of the division of a publicly traded company. The LBO deal will be financed with a significant amount of debt provided by a syndicate of banks. The debt schedule post-LBO is estimated to be as follows year by year: 0 1 End of Year: Debt 2. 325 3 250 4 200 400 At the time of the exit (at the end of year 4), you estimate the Enterprise Value (EV) of the company to be $400M. Stand alone, the company would have an unlevered beta of 1.25. The company is expected to remain in the same business. Assume a risk free rate of 2%, a market risk premium of 6%, and a tax rate of 40%. Assume that equity holders do not receive any dividends or other cash flows until the exit. a) If the LBO fund invests $100M, what is the expected i) multiple and ii) IRR? | b) Use the LBO Valuation Model to fill in the below table: 0 1 2 3 4 End of Year: Debt EV Equity D/E Beta U Beta L COE c) From year 0 to year 4, what happens to the levered beta? Explain the intuition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts