Question: Question 5: (30 points) Suppose that Jeffrey has initial wealth $10,000, but, before he consumes it, he is subject to the following health risk (these

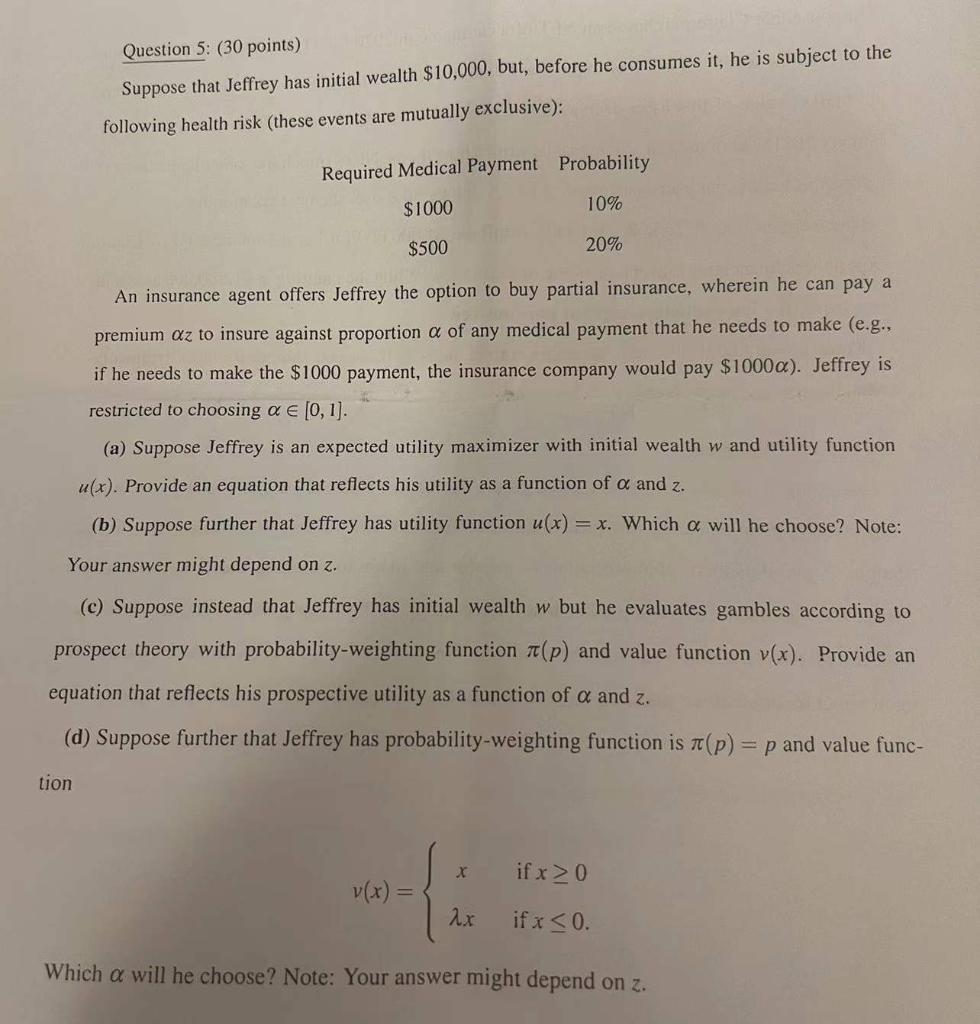

Question 5: (30 points) Suppose that Jeffrey has initial wealth $10,000, but, before he consumes it, he is subject to the following health risk (these events are mutually exclusive): Required Medical Payment Probability $1000 10% $500 20% An insurance agent offers Jeffrey the option to buy partial insurance, wherein he can pay a premium az to insure against proportion a of any medical payment that he needs to make (e.g., if he needs to make the $1000 payment, the insurance company would pay $1000a). Jeffrey is restricted to choosing a (0,1). (a) Suppose Jeffrey is an expected utility maximizer with initial wealth w and utility function u(x). Provide an equation that reflects his utility as a function of a and z. (b) Suppose further that Jeffrey has utility function u(x) = x. Which a will he choose? Note: Your answer might depend on z. (c) Suppose instead that Jeffrey has initial wealth w but he evaluates gambles according to prospect theory with probability-weighting function (p) and value function v(x). Provide an equation that reflects his prospective utility as a function of a and z. (d) Suppose further that Jeffrey has probability-weighting function is (p) = p and value func- tion if x > 0 v(x) = 2x if x 0 v(x) = 2x if x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts