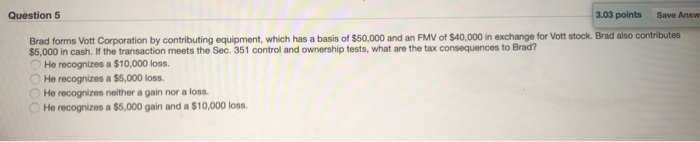

Question: Question 5 3.03 points Save Answ Brad forms Vott Corporation by contributing equipment, which has a basis of $50,000 and an FMV of $40,000 in

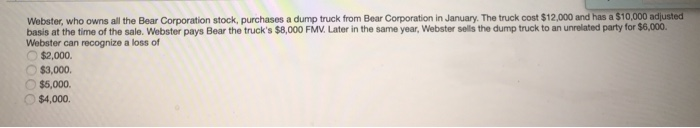

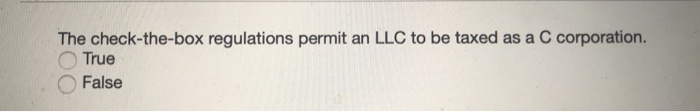

Question 5 3.03 points Save Answ Brad forms Vott Corporation by contributing equipment, which has a basis of $50,000 and an FMV of $40,000 in exchange for Vott stock. Brad also contributes $5,000 in cash. If the transaction meets the Sec. 351 control and ownership tests, what are the tax consequences to Brad? He recognizes a $10,000 loss. He recognizes a $5,000 loss, He recognizes neither again nor a los He recognizes a $5,000 gain and a $10,000 loss. Webster, who owns all the Bear Corporation stock, purchases a dump truck from Bear Corporation in January. The truck cost $12,000 and has a $10,000 adjusted basis at the time of the sale. Webster pays Bear the truck's $8,000 FMV. Later in the same year, Webster sells the dump truck to an unrelated party for $6,000 Webster can recognize a loss of $2,000 $3,000 $5,000. $4,000. The check-the-box regulations permit an LLC to be taxed as a C corporation. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts