Question: Question 5 3.62 A borrower has secured a 30 year, $320,000 loan at 7%. Ten years later, the borrower has the opportunity to refinance with

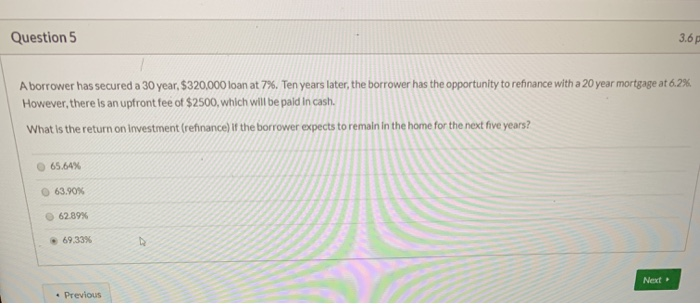

Question 5 3.62 A borrower has secured a 30 year, $320,000 loan at 7%. Ten years later, the borrower has the opportunity to refinance with a 20 year mortgage at 6.2% However, there is an upfront fee of $2500, which will be paid in cash. What is the return on investment (refinance) If the borrower expects to remain in the home for the next five years? 65.64% 63.90% 62.89% 69.33% Next Previous Question 5 3.62 A borrower has secured a 30 year, $320,000 loan at 7%. Ten years later, the borrower has the opportunity to refinance with a 20 year mortgage at 6.2% However, there is an upfront fee of $2500, which will be paid in cash. What is the return on investment (refinance) If the borrower expects to remain in the home for the next five years? 65.64% 63.90% 62.89% 69.33% Next Previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts