Question: QUESTION 5 4 marks RAK Ltd finances its operations as follows below: L The cost of bonds before tax is 8% per annum. II. The

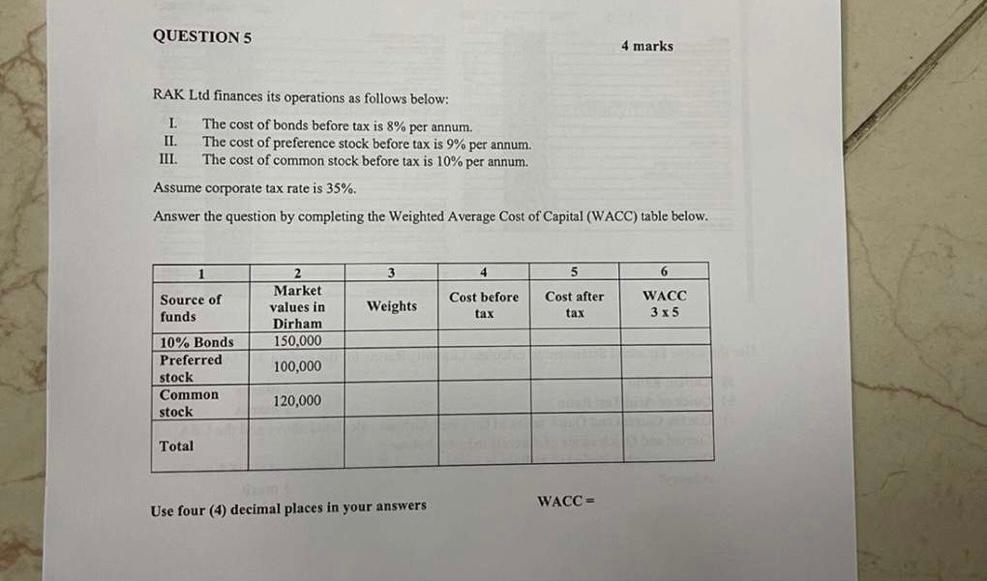

QUESTION 5 4 marks RAK Ltd finances its operations as follows below: L The cost of bonds before tax is 8% per annum. II. The cost of preference stock before tax is 9% per annum. The cost of common stock before tax is 10% per annum. III. Assume corporate tax rate is 35%. Answer the question by completing the Weighted Average Cost of Capital (WACC) table below. 5 6 Market Source of funds. values in Weights Cost before tax Cost after tax WACC 3x5 Dirham 10% Bonds 150,000 Preferred 100,000 stock Common 120,000 stock Total Mam 3 Use four (4) decimal places in your answers WACC=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts