Question: Question 5 (4 points) Hobart Ltd is considering two projects for its expansion plan - project A and project B. Both projects would run for

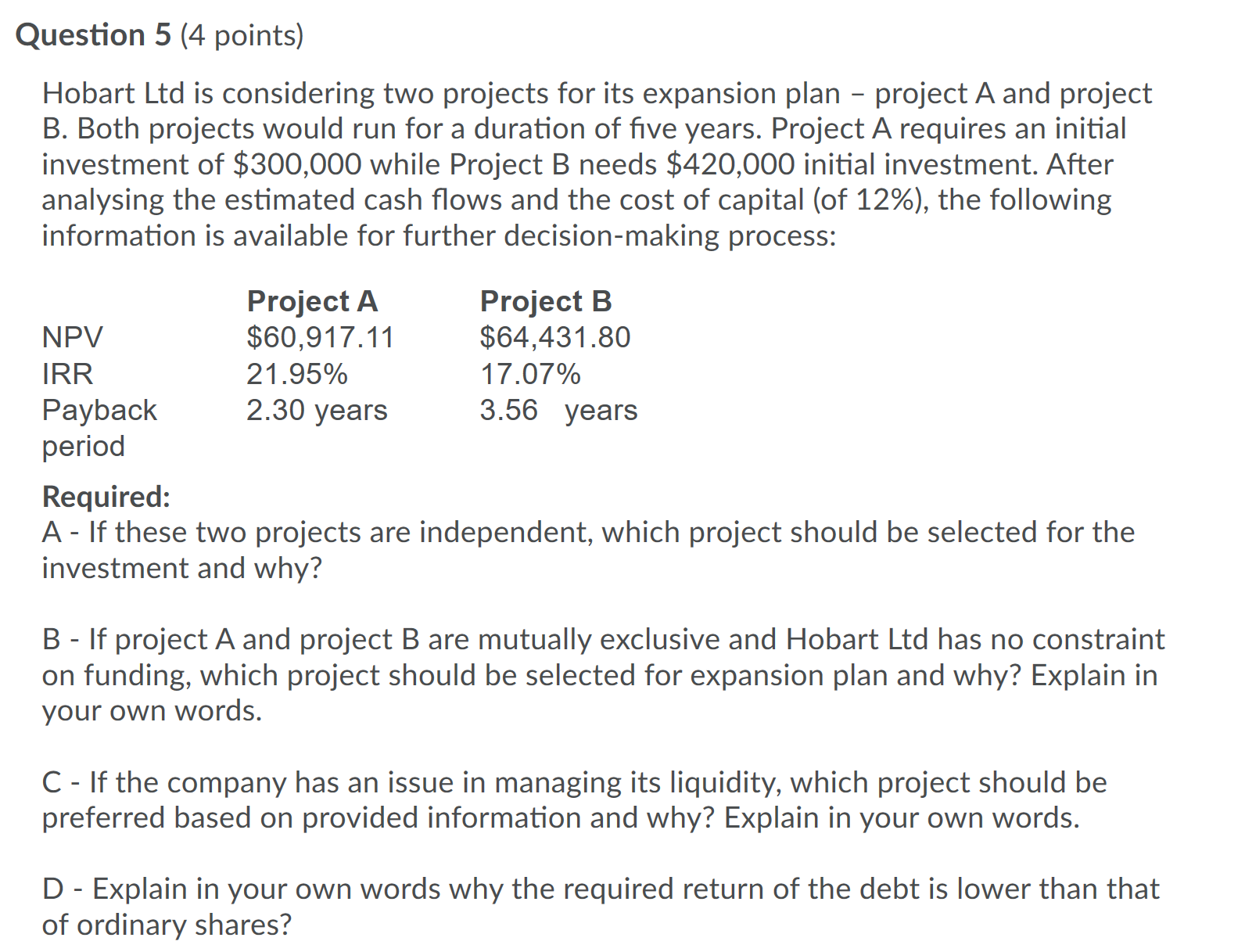

Question 5 (4 points) Hobart Ltd is considering two projects for its expansion plan - project A and project B. Both projects would run for a duration of five years. Project A requires an initial investment of $300,000 while Project B needs $420,000 initial investment. After analysing the estimated cash flows and the cost of capital (of 12%), the following information is available for further decision-making process: Project A Project B NPV $60,917.11 $64,431.80 IRR 21.95% 17.07% Payback 2.30 years 3.56 years period Required: A - If these two projects are independent, which project should be selected for the investment and why? B - If project A and project B are mutually exclusive and Hobart Ltd has no constraint on funding, which project should be selected for expansion plan and why? Explain in your own words. C - If the company has an issue in managing its liquidity, which project should be preferred based on provided information and why? Explain in your own words. D - Explain in your own words why the required return of the debt is lower than that of ordinary shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts