Question: Question 5 4 points Saved We defined the basis at time t as Bt = St-tFT. = If the market is in contango when you

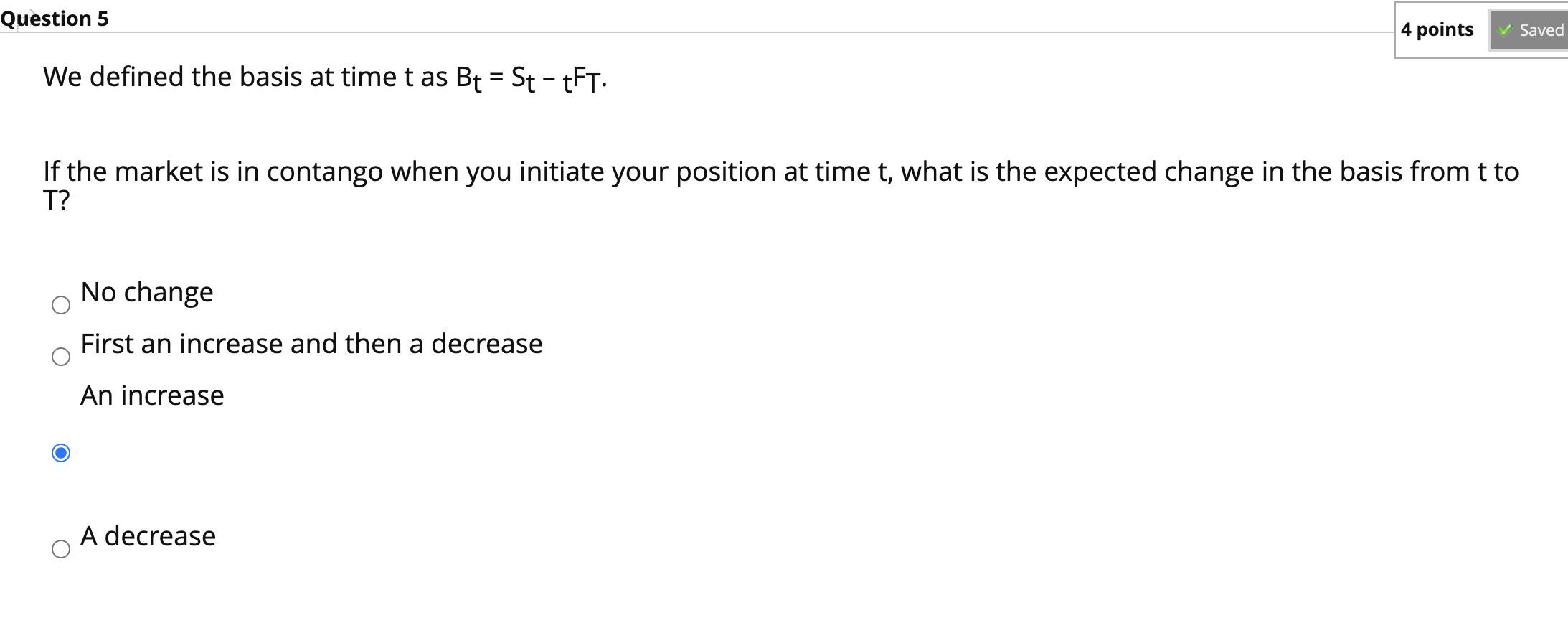

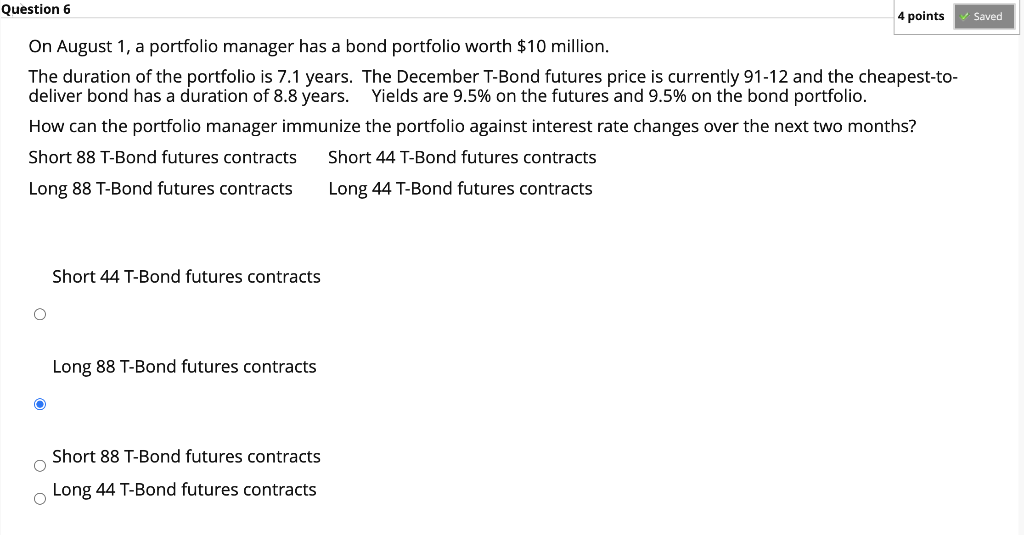

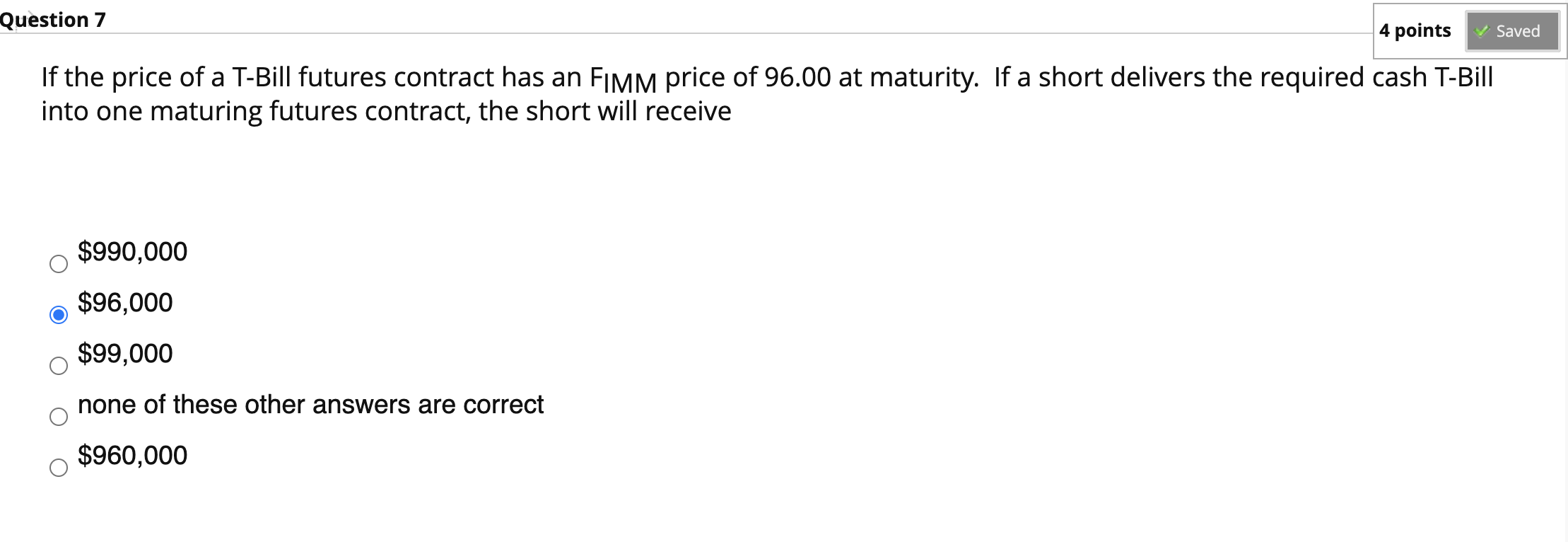

Question 5 4 points Saved We defined the basis at time t as Bt = St-tFT. = If the market is in contango when you initiate your position at time t, what is the expected change in the basis from t to T? No change First an increase and then a decrease An increase A decrease Question 6 4 points Saved On August 1, a portfolio manager has a bond portfolio worth $10 million. The duration of the portfolio is 7.1 years. The December T-Bond futures price is currently 91-12 and the cheapest-to- deliver bond has a duration of 8.8 years. Yields are 9.5% on the futures and 9.5% on the bond portfolio. How can the portfolio manager immunize the portfolio against interest rate changes over the next two months? Short 88 T-Bond futures contracts Short 44 T-Bond futures contracts Long 88 T-Bond futures contracts Long 44 T-Bond futures contracts Short 44 T-Bond futures contracts Long 88 T-Bond futures contracts Short 88 T-Bond futures contracts Long 44 T-Bond futures contracts Question 7 4 points Saved If the price of a T-Bill futures contract has an FIMM price of 96.00 at maturity. If a short delivers the required cash T-Bill into one maturing futures contract, the short will receive $990,000 $96,000 $99,000 none of these other answers are correct $960,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts