Question: QUESTION 5 5 p A $1000 face value bond has two years left to maturity, 4.5% coupon rate with annual coupons, and is currently trading

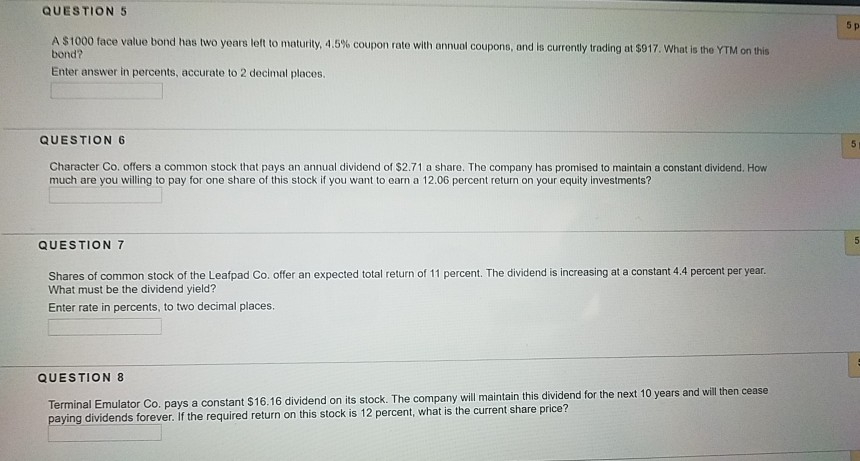

QUESTION 5 5 p A $1000 face value bond has two years left to maturity, 4.5% coupon rate with annual coupons, and is currently trading at $917. What is the YTM on this bond? Enter answer in percents, accurate to 2 decimal places QUESTION 6 Character Co. offers a common stock that pays an annual dividend of $2.71 a share. The company has promised to maintain a constant dividend. How much are you willing to pay for one share of this stock if you want to earn a 12.06 percent return on your equity Investments? QUESTION 7 Shares of common stock of the Leafpad Co. offer an expected total return of 11 percent. The dividend is increasing at a constant 4.4 percent per year. What must be the dividend yield? Enter rate in percents, to two decimal places. QUESTION 8 Terminal Emulator Co. pays a constant $16.16 dividend on its stock. The company will maintain this dividend for the next 10 years and will then cease paying dividends forever. If the required return on this stock is 12 percent, what is the current share price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts