Question: Question 5 5 points Save Answer You are trying to calculate the enterprise value of DCB Corp using a free cash flow model. To that

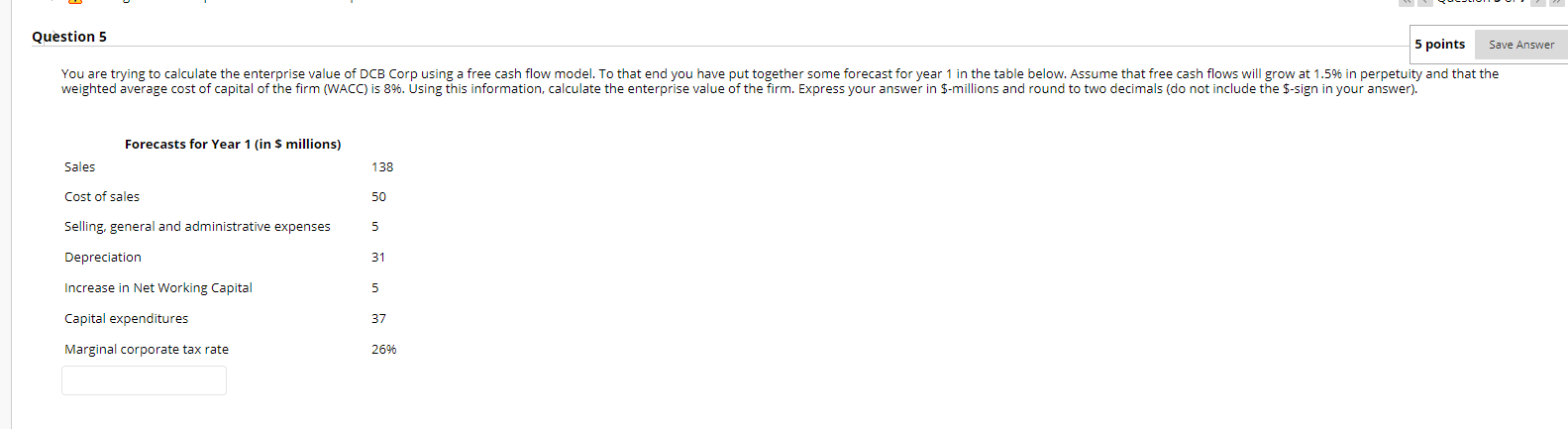

Question 5 5 points Save Answer You are trying to calculate the enterprise value of DCB Corp using a free cash flow model. To that end you have put together some forecast for year 1 in the table below. Assume that free cash flows will grow at 1.596 in perpetuity and that the weighted average cost of capital of the firm (WACC) is 89. Using this information, calculate the enterprise value of the firm. Express your answer in $-millions and round to two decimals (do not include the $-sign in your answer). Forecasts for Year 1 (in 9 millions) Sales 138 Cost of sales 50 Selling, general and administrative expenses 5 Depreciation 31 Increase in Net Working Capital 5 Capital expenditures 37 Marginal corporate tax rate 2696

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts