Question: Question 5 (5 points) Saved Keenan Industries has a bond outstanding with 15 years to maturity, an 8.25% nominal coupon, semiannual payments, and a $1,000

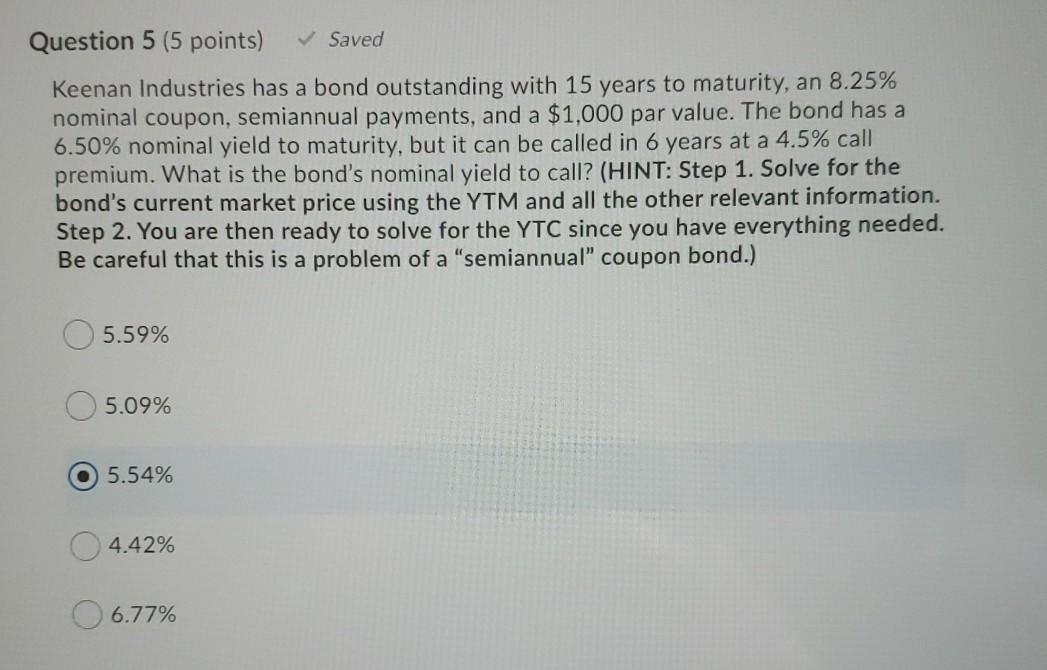

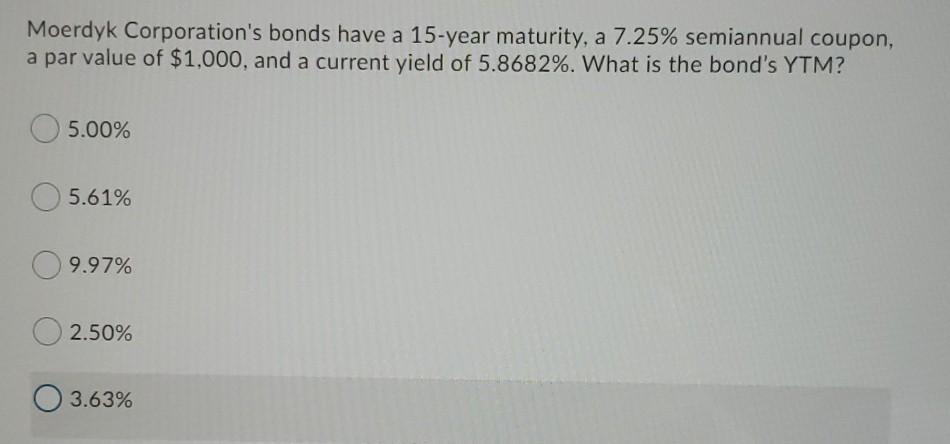

Question 5 (5 points) Saved Keenan Industries has a bond outstanding with 15 years to maturity, an 8.25% nominal coupon, semiannual payments, and a $1,000 par value. The bond has a 6.50% nominal yield to maturity, but it can be called in 6 years at a 4.5% call premium. What is the bond's nominal yield to call? (HINT: Step 1. Solve for the bond's current market price using the YTM and all the other relevant information. Step 2. You are then ready to solve for the YTC since you have everything needed. Be careful that this is a problem of a "semiannual" coupon bond.) 5.59% 5.09% 5.54% 4.42% 6.77% Moerdyk Corporation's bonds have a 15-year maturity, a 7.25% semiannual coupon, a par value of $1,000, and a current yield of 5.8682%. What is the bond's YTM? 5.00% 5.61% 9.97% 2.50% 3.63%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts