Question: Question 5 (5 points) The standard deviation of the changes in the price of a futures contract is 18% per year and the standard deviation

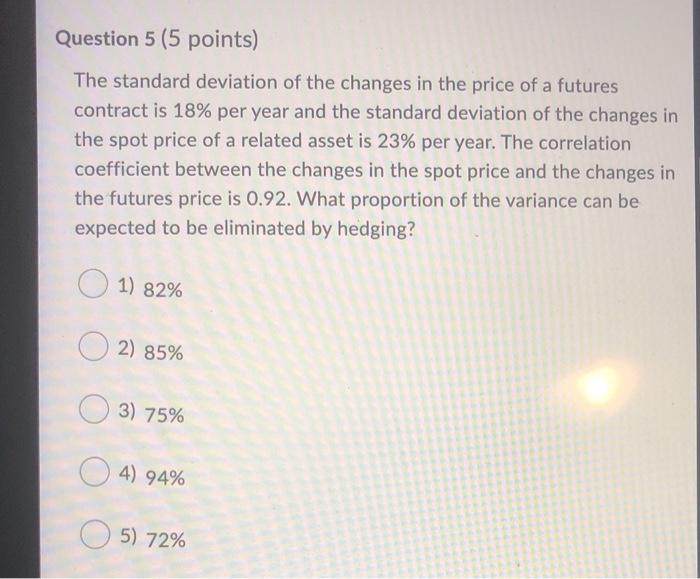

Question 5 (5 points) The standard deviation of the changes in the price of a futures contract is 18% per year and the standard deviation of the changes in the spot price of a related asset is 23% per year. The correlation coefficient between the changes in the spot price and the changes in the futures price is 0.92. What proportion of the variance can be expected to be eliminated by hedging? 1) 82% 2) 85% 3) 75% 4) 94% 5) 72%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts