Question: Question 5 (8 points) Redoubt LLC exchanged an office building used in its business for a manufacturing building to be used in its business. Redoubt

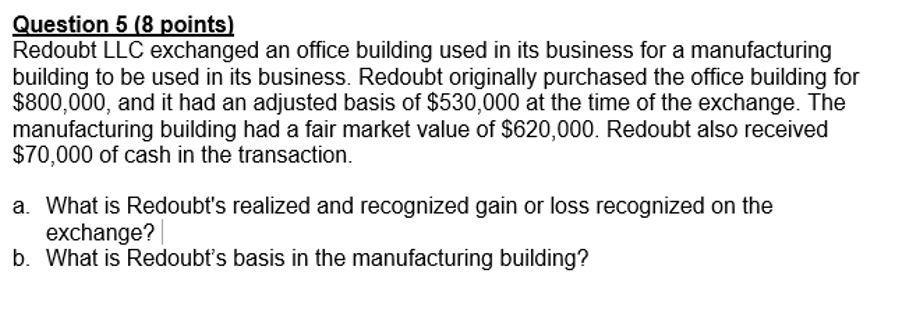

Question 5 (8 points) Redoubt LLC exchanged an office building used in its business for a manufacturing building to be used in its business. Redoubt originally purchased the office building for $800,000, and it had an adjusted basis of $530,000 at the time of the exchange. The manufacturing building had a fair market value of $620,000. Redoubt also received $70,000 of cash in the transaction. a. What is Redoubt's realized and recognized gain or loss recognized on the exchange? b. What is Redoubt's basis in the manufacturing building

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock