Question: Question 5 [95 points] Universal Maintenance Co. initiated a defined benefit pension plan for its employees on January 1, 2015. The plan trustee has provided

![Question 5 [95 points] Universal Maintenance Co. initiated a defined benefit](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66facbdd420ae_22066facbdca2956.jpg)

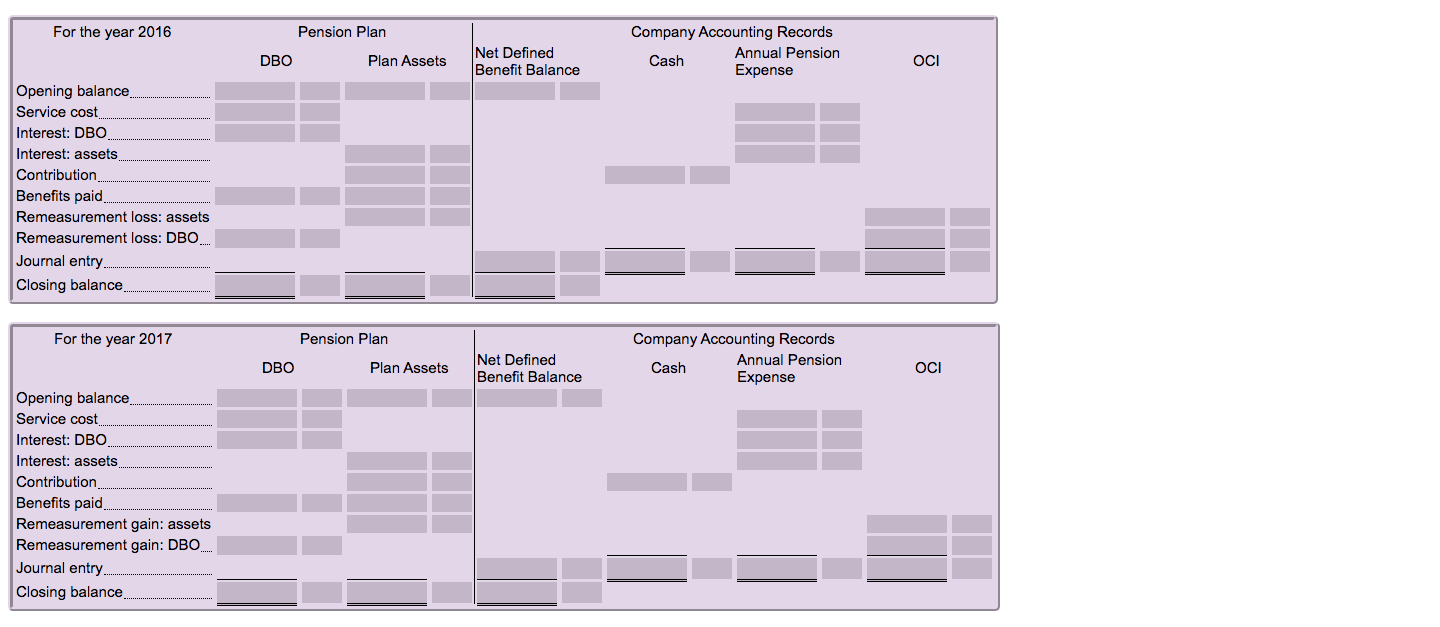

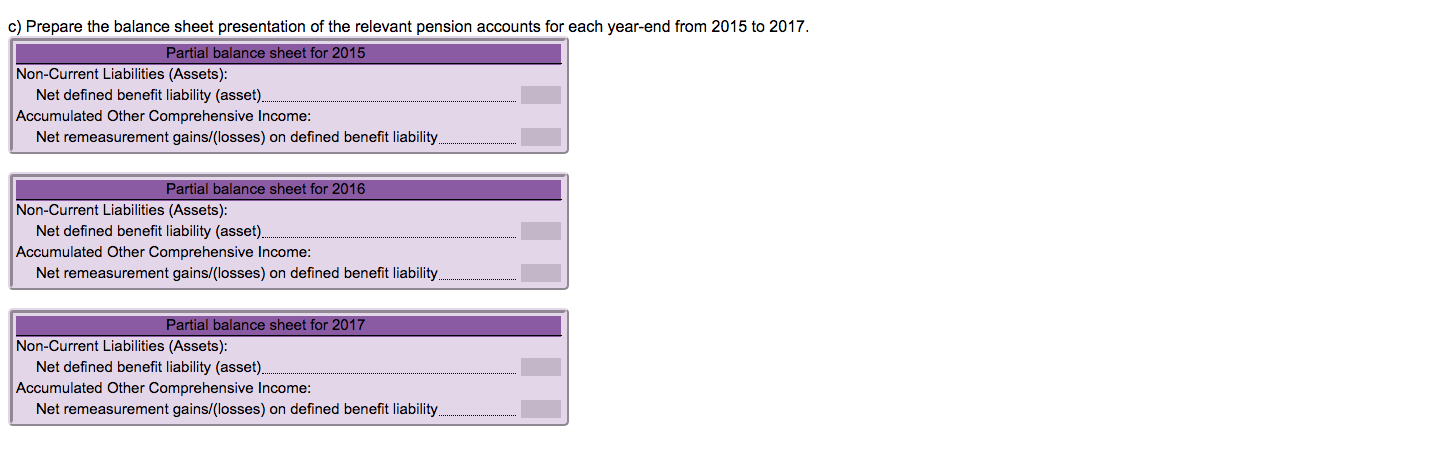

Question 5 [95 points] Universal Maintenance Co. initiated a defined benefit pension plan for its employees on January 1, 2015. The plan trustee has provided the following information: final answer(s) are accurate to the nearest whole number. a) Complete the pension worksheets for the years 2015 to 2017 . Note: Please ensure that all answer fields, including zero dollar amounts, in the worksheets are filled in. b) Prepare the journal entries required for the years 2015 to 2017 . c) Prepare the balance sheet presentation of the relevant pension accounts for each year-end from 2015 to 2017 . Partial balance sheet for 2015 Non-Current Liabilities (Assets): Net defined benefit liability (asset) Accumulated Other Comprehensive Income: Net remeasurement gains/(losses) on defined benefit liability. Partial balance sheet for 2016 Non-Current Liabilities (Assets): Net defined benefit liability (asset) Accumulated Other Comprehensive Income: Net remeasurement gains/(losses) on defined benefit liability Partial balance sheet for 2017 Non-Current Liabilities (Assets): Net defined benefit liability (asset) Accumulated Other Comprehensive Income: Net remeasurement gains/(losses) on defined benefit liability. Question 5 [95 points] Universal Maintenance Co. initiated a defined benefit pension plan for its employees on January 1, 2015. The plan trustee has provided the following information: final answer(s) are accurate to the nearest whole number. a) Complete the pension worksheets for the years 2015 to 2017 . Note: Please ensure that all answer fields, including zero dollar amounts, in the worksheets are filled in. b) Prepare the journal entries required for the years 2015 to 2017 . c) Prepare the balance sheet presentation of the relevant pension accounts for each year-end from 2015 to 2017 . Partial balance sheet for 2015 Non-Current Liabilities (Assets): Net defined benefit liability (asset) Accumulated Other Comprehensive Income: Net remeasurement gains/(losses) on defined benefit liability. Partial balance sheet for 2016 Non-Current Liabilities (Assets): Net defined benefit liability (asset) Accumulated Other Comprehensive Income: Net remeasurement gains/(losses) on defined benefit liability Partial balance sheet for 2017 Non-Current Liabilities (Assets): Net defined benefit liability (asset) Accumulated Other Comprehensive Income: Net remeasurement gains/(losses) on defined benefit liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts