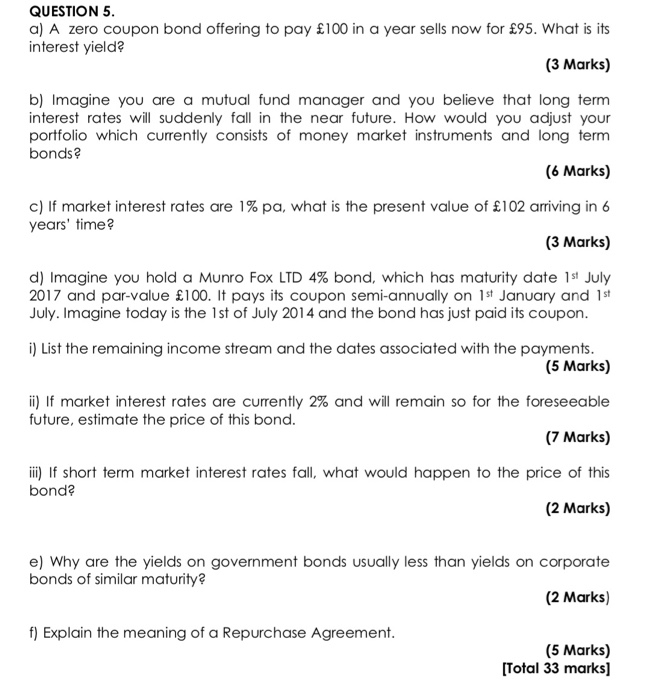

Question: QUESTION 5 a) A zero coupon bond offering to pay 100 in a year sells now for 95. What is it:s interest yield? (3 Marks)

QUESTION 5 a) A zero coupon bond offering to pay 100 in a year sells now for 95. What is it:s interest yield? (3 Marks) b) Imagine you are a mutual fund manager and you believe that long term interest rates will suddenly fall in the near future. How would you adjust your portfolio which currently consists of money market instruments and long term bonds? (6 Marks) c) If market interest rates are 1% pa, what is the present value of 102 arriving in 6 years' time? (3 Marks) d) Imagine you hold a Munro Fox LTD 4% bond, which has maturity date 1st July 2017 and par-value 100. It pays its coupon semi-annually on 1st January and 1st July. Imagine today is the 1st of July 2014 and the bond has just paid its coupon i) List the remaining income stream and the dates associated with the payments (5 Marks) ii) If market interest rates are currently 2% and will remain so for the foreseeable (7 Marks) ii) If short term market interest rates fall, what would happen to the price of this (2 Marks) future, estimate the price of this bond bond? e) Why are the yields on government bonds usually less than yields on corporate bonds of similar maturity? (2 Marks) f) Explain the meaning of a Repurchase Agreement (5 Marks) Total 33 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts