Question: QUESTION 5 A bond that had a 20 year original maturity with 1 year left to maturity has more price risk than a 10 year

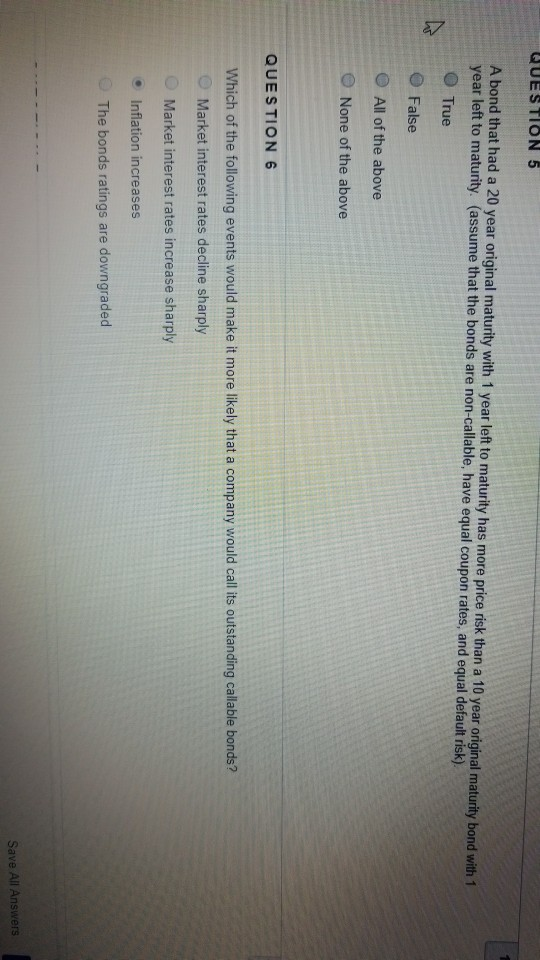

QUESTION 5 A bond that had a 20 year original maturity with 1 year left to maturity has more price risk than a 10 year original maturity bond with 1 year left to maturity. (assume that the bonds are non-callable, have equal coupon rates, and equal default risk) O True O False O All of the above None of the above QUESTION 6 Which of the following events would make it more likely that a company would call its outstanding callable bonds? Market interest rates decline sharply Market interest rates increase sharply . Inflation increases The bonds ratings are downgraded

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock