Question: Question 5 (a) Briefly explain the risk-shifting problem. (2 marks) Consider a risk neutral entrepreneur who has two investment opportunities. Both require an investment of

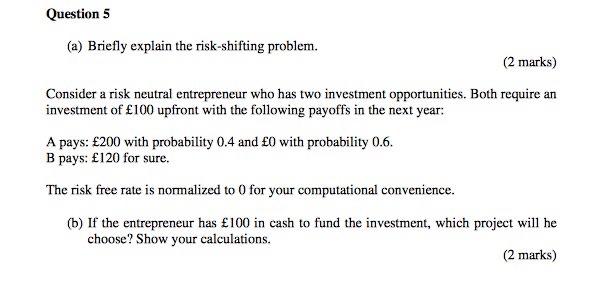

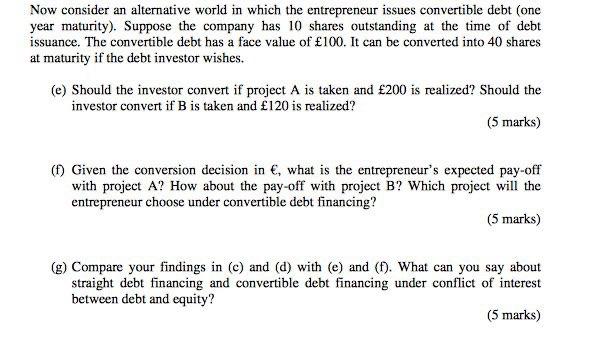

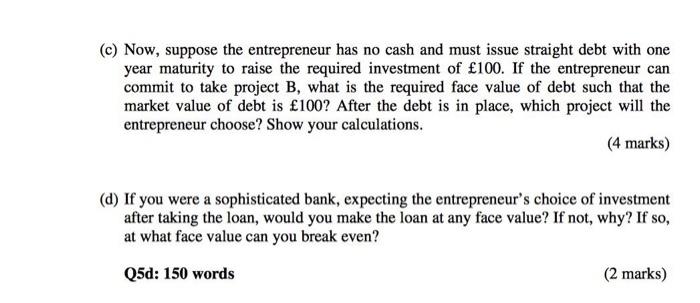

Question 5 (a) Briefly explain the risk-shifting problem. (2 marks) Consider a risk neutral entrepreneur who has two investment opportunities. Both require an investment of 100 upfront with the following payoffs in the next year: A pays: 200 with probability 0.4 and 0 with probability 0.6. B pays: 120 for sure. The risk free rate is normalized to 0 for your computational convenience. (b) If the entrepreneur has 100 in cash to fund the investment, which project will he choose? Show your calculations. (2 marks) Now consider an alternative world in which the entrepreneur issues convertible debt (one year maturity). Suppose the company has 10 shares outstanding at the time of debt issuance. The convertible debt has a face value of 100. It can be converted into 40 shares at maturity if the debt investor wishes. (e) Should the investor convert if project A is taken and 200 is realized? Should the investor convert if B is taken and 120 is realized? (5 marks) (1) Given the conversion decision in , what is the entrepreneur's expected pay-off with project A? How about the pay-off with project B? Which project will the entrepreneur choose under convertible debt financing? (5 marks) (g) Compare your findings in (c) and (d) with (e) and (1). What can you say about straight debt financing and convertible debt financing under conflict of interest between debt and equity? (5 marks) (c) Now, suppose the entrepreneur has no cash and must issue straight debt with one year maturity to raise the required investment of 100. If the entrepreneur can commit to take project B, what is the required face value of debt such that the market value of debt is 100? After the debt is in place, which project will the entrepreneur choose? Show your calculations. (4 marks) (d) If you were a sophisticated bank, expecting the entrepreneur's choice of investment after taking the loan, would you make the loan at any face value? If not, why? If so, at what face value can you break even? Q5d: 150 words (2 marks) Question 5 (a) Briefly explain the risk-shifting problem. (2 marks) Consider a risk neutral entrepreneur who has two investment opportunities. Both require an investment of 100 upfront with the following payoffs in the next year: A pays: 200 with probability 0.4 and 0 with probability 0.6. B pays: 120 for sure. The risk free rate is normalized to 0 for your computational convenience. (b) If the entrepreneur has 100 in cash to fund the investment, which project will he choose? Show your calculations. (2 marks) Now consider an alternative world in which the entrepreneur issues convertible debt (one year maturity). Suppose the company has 10 shares outstanding at the time of debt issuance. The convertible debt has a face value of 100. It can be converted into 40 shares at maturity if the debt investor wishes. (e) Should the investor convert if project A is taken and 200 is realized? Should the investor convert if B is taken and 120 is realized? (5 marks) (1) Given the conversion decision in , what is the entrepreneur's expected pay-off with project A? How about the pay-off with project B? Which project will the entrepreneur choose under convertible debt financing? (5 marks) (g) Compare your findings in (c) and (d) with (e) and (1). What can you say about straight debt financing and convertible debt financing under conflict of interest between debt and equity? (5 marks) (c) Now, suppose the entrepreneur has no cash and must issue straight debt with one year maturity to raise the required investment of 100. If the entrepreneur can commit to take project B, what is the required face value of debt such that the market value of debt is 100? After the debt is in place, which project will the entrepreneur choose? Show your calculations. (4 marks) (d) If you were a sophisticated bank, expecting the entrepreneur's choice of investment after taking the loan, would you make the loan at any face value? If not, why? If so, at what face value can you break even? Q5d: 150 words (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts