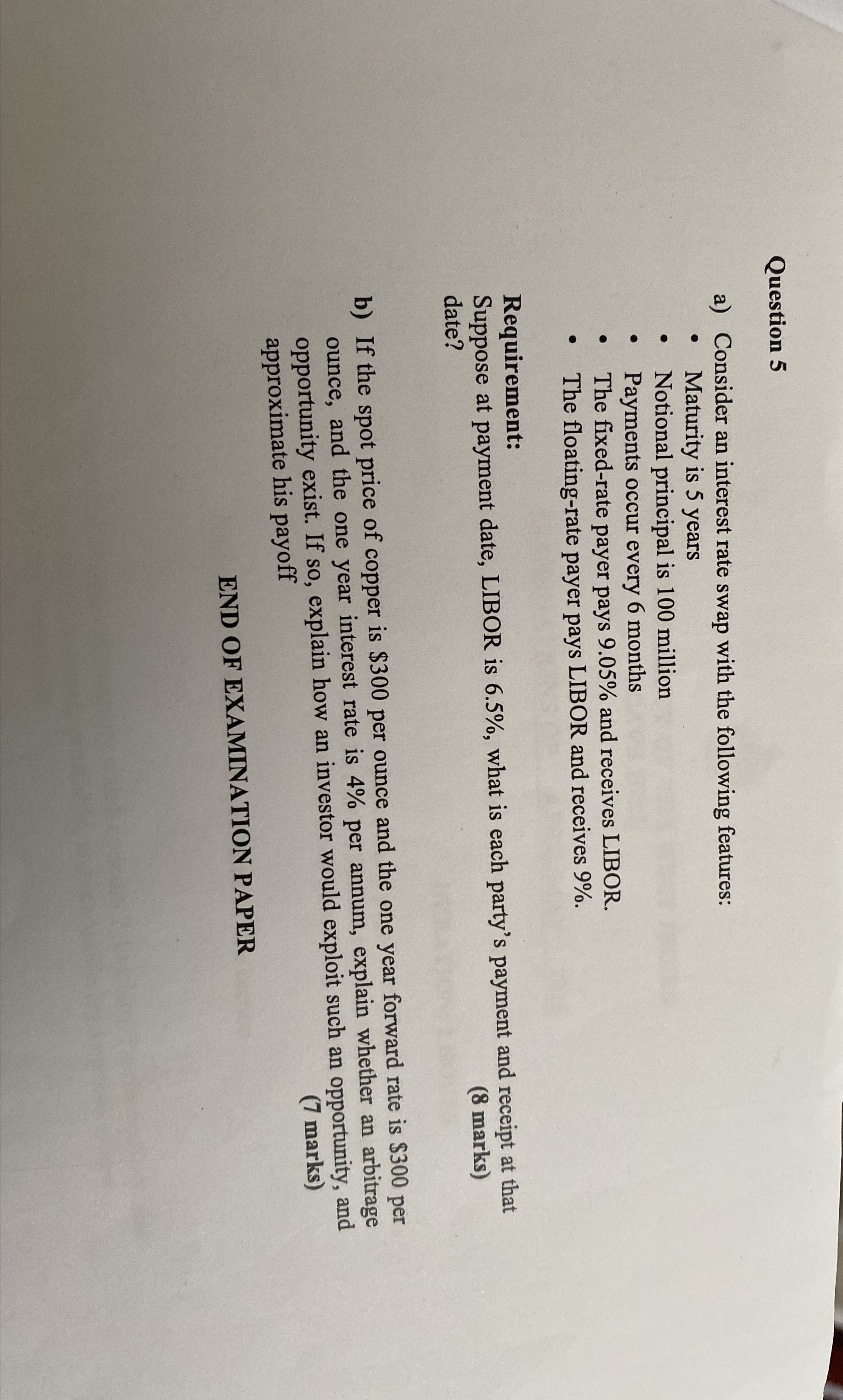

Question: Question 5 a ) Consider an interest rate swap with the following features: Maturity is 5 years Notional principal is 1 0 0 million Payments

Question

a Consider an interest rate swap with the following features:

Maturity is years

Notional principal is million

Payments occur every months

The fixedrate payer pays and receives LIBOR.

The floatingrate payer pays LIBOR and receives

Requirement:

Suppose at payment date, LIBOR is what is each party's payment and receipt at that date?

marks

b If the spot price of copper is $ per ounce and the one year forward rate is $ per ounce, and the one year interest rate is per annum, explain whether an arbitrage opportunity exist. If so explain how an investor would exploit such an opportunity, and approximate his payoff

marks

END OF EXAMINATION PAPER

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock