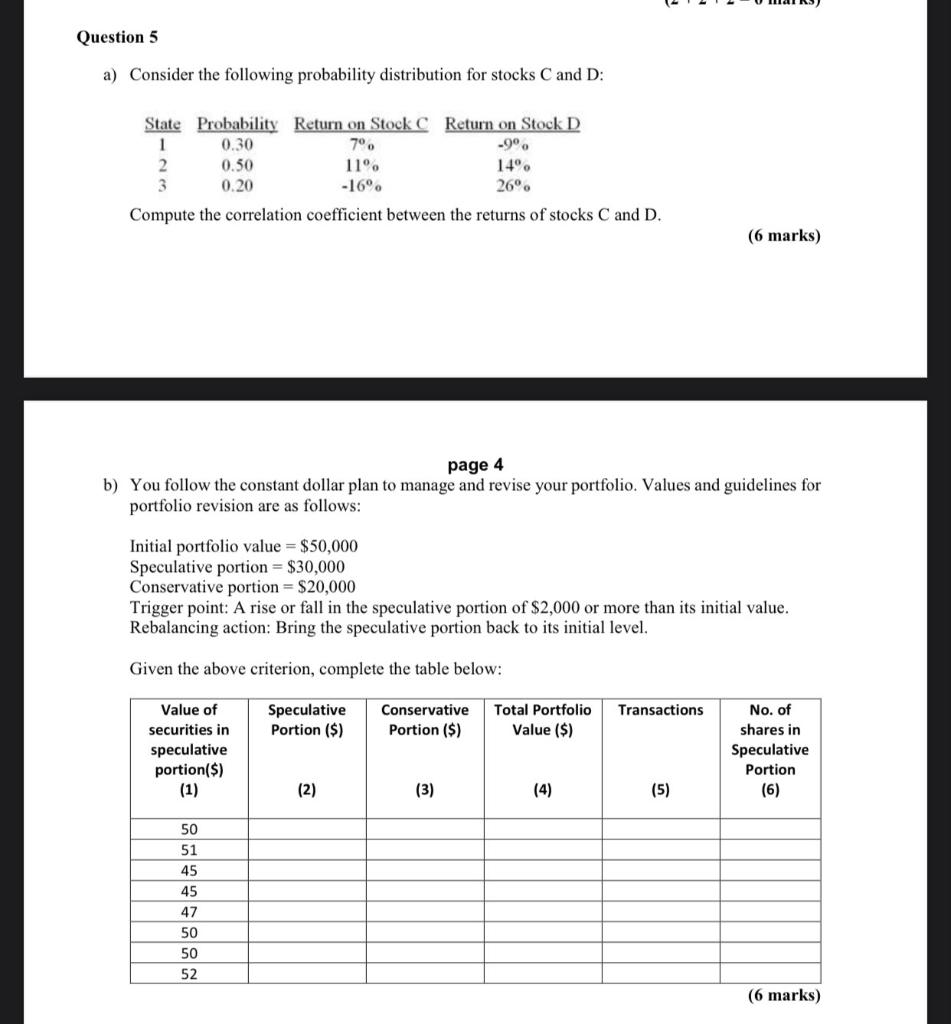

Question: Question 5 a) Consider the following probability distribution for stocks C and D: State Probability Return on Stock Return on Stock D 1 0.30 70.

Question 5 a) Consider the following probability distribution for stocks C and D: State Probability Return on Stock Return on Stock D 1 0.30 70. -9 2 0.50 11 14 3 0.20 -16% 26. Compute the correlation coefficient between the returns of stocks C and D. (6 marks) page 4 b) You follow the constant dollar plan to manage and revise your portfolio. Values and guidelines for portfolio revision are as follows: Initial portfolio value = $50,000 Speculative portion = $30,000 Conservative portion = $20,000 Trigger point: A rise or fall in the speculative portion of $2,000 or more than its initial value. Rebalancing action: Bring the speculative portion back to its initial level. Given the above criterion, complete the table below: Transactions Speculative Portion ($) Conservative Portion ($) Total Portfolio Value ($) Value of securities in speculative portion($) (1) No. of shares in Speculative Portion (6) (2) (3) (4) (5) 50 51 45 45 47 50 50 52 (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts