Question: Question 5: a) Discuss immunization as a passive bond portfolio management strategy. (20%) b) Suppose you are thinking of investing some money in bonds. You

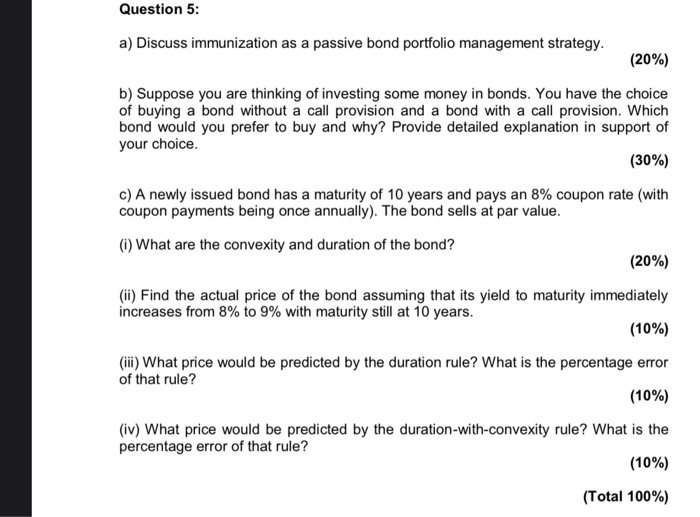

Question 5: a) Discuss immunization as a passive bond portfolio management strategy. (20%) b) Suppose you are thinking of investing some money in bonds. You have the choice of buying a bond without a call provision and a bond with a call provision. Which bond would you prefer to buy and why? Provide detailed explanation in support of your choice. (30%) c) A newly issued bond has a maturity of 10 years and pays an 8% coupon rate (with coupon payments being once annually). The bond sells at par value. (1) What are the convexity and duration of the bond? (20%) (ii) Find the actual price of the bond assuming that its yield to maturity immediately increases from 8% to 9% with maturity still at 10 years. (10%) (ii) What price would be predicted by the duration rule? What is the percentage error of that rule? (10%) (iv) What price would be predicted by the duration-with-convexity rule? What is the percentage error of that rule? (10%) (Total 100%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts