Question: Question 5 a. Explain the difference between a regular CDS and a binary CDS. Which one is more suitable for hedging? Which one is more

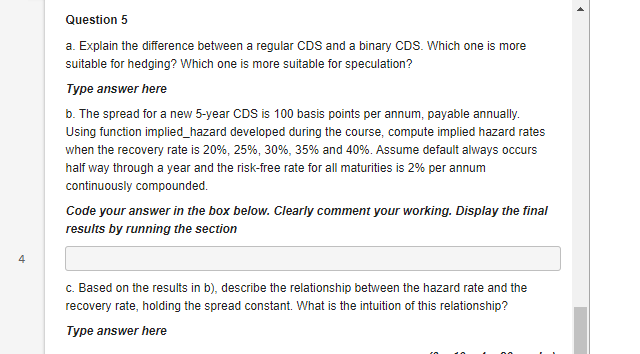

Question 5 a. Explain the difference between a regular CDS and a binary CDS. Which one is more suitable for hedging? Which one is more suitable for speculation? Type answer here b. The spread for a new 5-year CDS is 100 basis points per annum, payable annually. Using function implied_hazard developed during the course, compute implied hazard rates when the recovery rate is 20%, 25%, 30%, 35% and 40%. Assume default always occurs half way through a year and the risk-free rate for all maturities is 2% per annum continuously compounded. Code your answer in the box below. Clearly comment your working. Display the final results by running the section 4 c. Based on the results in b), describe the relationship between the hazard rate and the recovery rate, holding the spread constant. What is the intuition of this relationship? Type answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts