Question: QUESTION 5 a) Extrabig Corporation needs RM30 million for its new project. The corporation can decide to obtain funds either through the following sources: i)

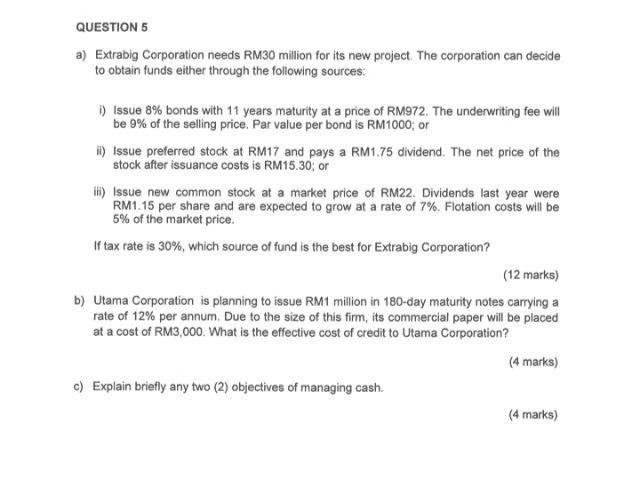

QUESTION 5 a) Extrabig Corporation needs RM30 million for its new project. The corporation can decide to obtain funds either through the following sources: i) Issue 8% bonds with 11 years maturity at a price of RM972. The underwriting fee will be 9% of the selling price. Par value per bond is RM1000; or ii) Issue preferred stock at RM17 and pays a RM1.75 dividend. The net price of the stock after issuance costs is RM15.30; or iii) Issue new common stock at a market price of RM22. Dividends last year were RM1.15 per share and are expected to grow at a rate of 7%. Flotation costs will be 5% of the market price. If tax rate is 30%, which source of fund is the best for Extrabig Corporation? (12 marks) b) Utama Corporation is planning to issue RM1 million in 180-day maturity notes carrying a rate of 12% per annum. Due to the size of this firm, its commercial paper will be placed at a cost of RM3,000. What is the effective cost of credit to Utama Corporation? c) Explain briefly any two (2) objectives of managing cash. (4 marks) (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts