Question: QUESTION 5 A project will produce an operating cash flow of $143,000 a year for three years. The initial cash outlay for equipment will be

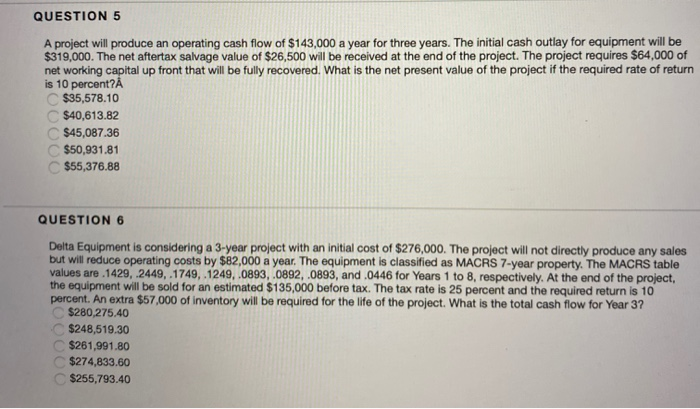

QUESTION 5 A project will produce an operating cash flow of $143,000 a year for three years. The initial cash outlay for equipment will be $319,000. The net aftertax salvage value of $26,500 will be received at the end of the project. The project requires $64,000 of net working capital up front that will be fully recovered. What is the net present value of the project if the required rate of return is 10 percent? $35,578.10 $40,613.82 $45,087.36 $50,931.81 $55,376.88 QUESTION 6 Delta Equipment is considering a 3-year project with an initial cost of $276,000. The project will not directly produce any sales but will reduce operating costs by $62,000 a year. The equipment is classified as MACRS 7-year property. The MACRS table values are 1429, 2449, 1749, 1249.0893,.0892, .0893, and .0446 for Years 1 to 8, respectively. At the end of the project, the equipment will be sold for an estimated $135,000 before tax. The tax rate is 25 percent and the required return is 10 percent. An extra $57,000 of inventory will be required for the life of the project. What is the total cash flow for Year 3? $280,275.40 $248,519.30 $261,991.80 $274,833.60 $255,793.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts