Question: QUESTION 5: a) The 4G/ has complained about recent high taxes on investment. Suppose that a firm is taxed at rate : on profits such

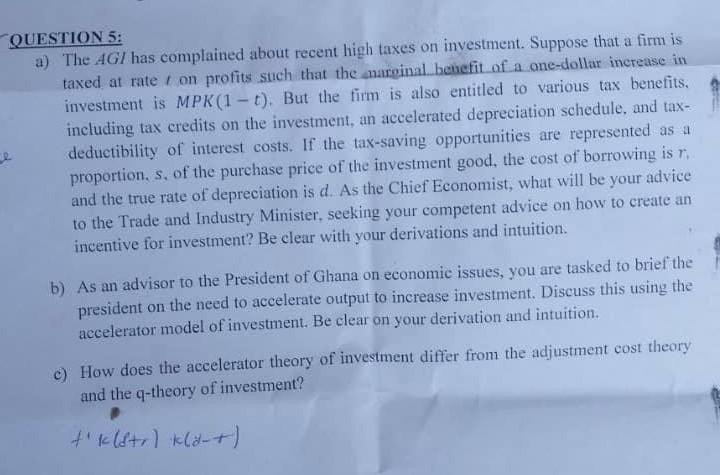

QUESTION 5: a) The 4G/ has complained about recent high taxes on investment. Suppose that a firm is taxed at rate : on profits such that the marginal benefit of a one-dollar increase in investment is MPK (1 t). But the firm is also entitled to various tax benefits, including tax credits on the investment, an accelerated depreciation schedule, and tax- deductibility of interest costs. If the tax-saving opportunities are represented as a proportion, s. of the purchase price of the investment good, the cost of borrowing is n and the true rate of depreciation is d. As the Chief Economist, what will be your advice to the Trade and Industry Minister, seeking your competent advice on how to create an incentive for investment? Be clear with your derivations and intuition. e b) As an advisor to the President of Ghana on economic issues, you are tasked to brief the president on the need to accelerate output to increase investment. Discuss this using the accelerator model of investment. Be clear on your derivation and intuition. c) How does the accelerator theory of investment differ from the adjustment cost theory and the q-theory of investment? t'k (str) klat)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts