Question: Question 5 a) The below information is extracted from ABC Shipping Asia Ltd's balance sheet. Additional information: - The ordinary shares are currently traded at

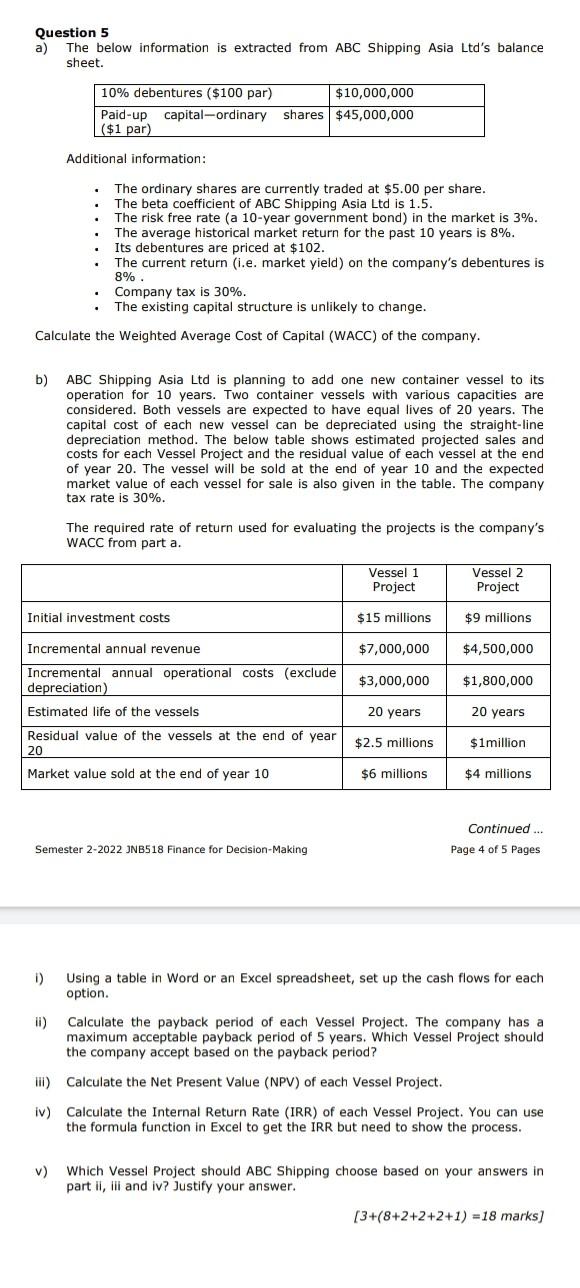

Question 5 a) The below information is extracted from ABC Shipping Asia Ltd's balance sheet. Additional information: - The ordinary shares are currently traded at $5.00 per share. - The beta coefficient of ABC Shipping Asia Ltd is 1.5. - The risk free rate (a 10-year government bond) in the market is 3%. - The average historical market return for the past 10 years is 8%. - Its debentures are priced at $102. - The current return (i.e. market yield) on the company's debentures is 8% - Company tax is 30%. - The existing capital structure is unlikely to change. Calculate the Weighted Average Cost of Capital (WACC) of the company. b) ABC Shipping Asia Ltd is planning to add one new container vessel to its operation for 10 years. Two container vessels with various capacities are considered. Both vessels are expected to have equal lives of 20 years. The capital cost of each new vessel can be depreciated using the straight-line depreciation method. The below table shows estimated projected sales and costs for each Vessel Project and the residual value of each vessel at the end of year 20 . The vessel will be sold at the end of year 10 and the expected market value of each vessel for sale is also given in the table. The company tax rate is 30%. The required rate of return used for evaluating the projects is the company's WACC from part a. Semester2-2022JNB518FinanceforDecision-MakingContinued...Page4of5Pages Semester 2-2022 JNB518 Finance for Decision-Making i) Using a table in Word or an Excel spreadsheet, set up the cash flows for each option. ii) Calculate the payback period of each Vessel Project. The company has a maximum acceptable payback period of 5 years. Which Vessel Project should the company accept based on the payback period? iii) Calculate the Net Present Value (NPV) of each Vessel Project. iv) Calculate the Internal Return Rate (IRR) of each Vessel Project. You can use the formula function in Excel to get the IRR but need to show the process. v) Which Vessel Project should ABC Shipping choose based on your answers in part ii, iii and iv? Justify your answer. [3+(8+2+2+2+1)=18marks] Question 5 a) The below information is extracted from ABC Shipping Asia Ltd's balance sheet. Additional information: - The ordinary shares are currently traded at $5.00 per share. - The beta coefficient of ABC Shipping Asia Ltd is 1.5. - The risk free rate (a 10-year government bond) in the market is 3%. - The average historical market return for the past 10 years is 8%. - Its debentures are priced at $102. - The current return (i.e. market yield) on the company's debentures is 8% - Company tax is 30%. - The existing capital structure is unlikely to change. Calculate the Weighted Average Cost of Capital (WACC) of the company. b) ABC Shipping Asia Ltd is planning to add one new container vessel to its operation for 10 years. Two container vessels with various capacities are considered. Both vessels are expected to have equal lives of 20 years. The capital cost of each new vessel can be depreciated using the straight-line depreciation method. The below table shows estimated projected sales and costs for each Vessel Project and the residual value of each vessel at the end of year 20 . The vessel will be sold at the end of year 10 and the expected market value of each vessel for sale is also given in the table. The company tax rate is 30%. The required rate of return used for evaluating the projects is the company's WACC from part a. Semester2-2022JNB518FinanceforDecision-MakingContinued...Page4of5Pages Semester 2-2022 JNB518 Finance for Decision-Making i) Using a table in Word or an Excel spreadsheet, set up the cash flows for each option. ii) Calculate the payback period of each Vessel Project. The company has a maximum acceptable payback period of 5 years. Which Vessel Project should the company accept based on the payback period? iii) Calculate the Net Present Value (NPV) of each Vessel Project. iv) Calculate the Internal Return Rate (IRR) of each Vessel Project. You can use the formula function in Excel to get the IRR but need to show the process. v) Which Vessel Project should ABC Shipping choose based on your answers in part ii, iii and iv? Justify your answer. [3+(8+2+2+2+1)=18marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts