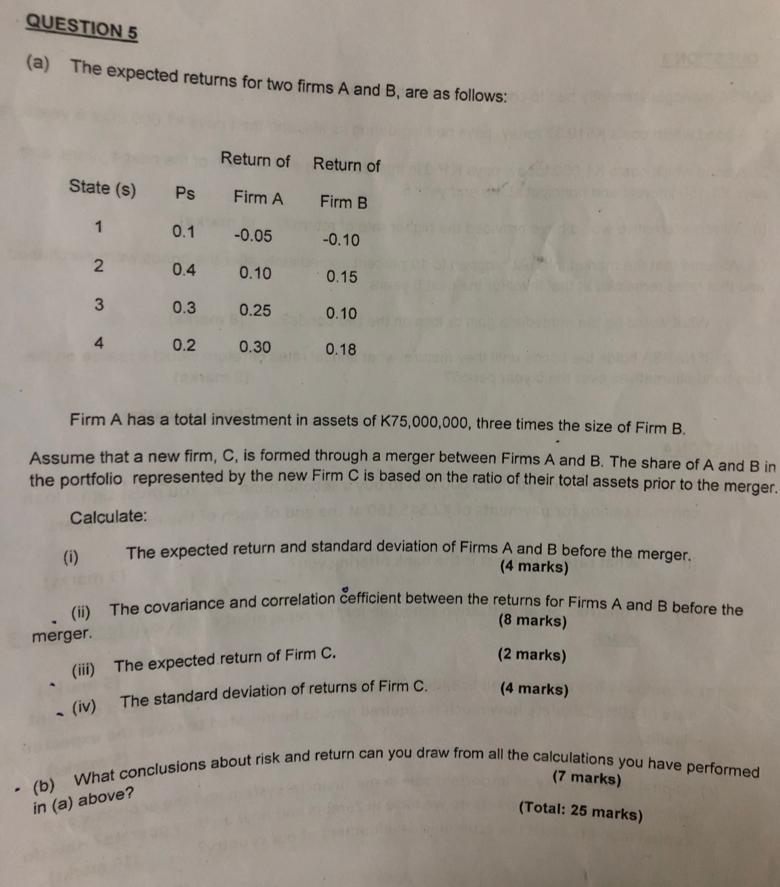

Question: QUESTION 5 (a) The expected returns for two firms A and B, are as follows: Return of Return of State (s) Ps Firm A Firm

QUESTION 5 (a) The expected returns for two firms A and B, are as follows: Return of Return of State (s) Ps Firm A Firm B 1 0.1 -0.05 -0.10 2 0.4 0.10 0.15 3 0.3 0.25 0.10 4 0.2 0.30 0.18 Firm A has a total investment in assets of K75,000,000, three times the size of Firm B. Assume that a new firm, C, is formed through a merger between Firms A and B. The share of A and B in the portfolio represented by the new Firm C is based on the ratio of their total assets prior to the merger. Calculate: 0 The expected return and standard deviation of Firms A and B before the merger. (4 (ii) The covariance and correlation cefficient between the returns for Firms A and B before the (8 marks) merger. (iii) The expected return of Firm C. (iv) The standard deviation of returns of Firm C. (2 marks) (4 marks) (b) What conclusions about risk and return can you draw from all the calculations you have performed (7 marks) in (a) above? (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts