Question: Question 5 a. Your CFO asks you to borrow 10 million for one-year period. However, the interest needs to be paid on quarterly basis at

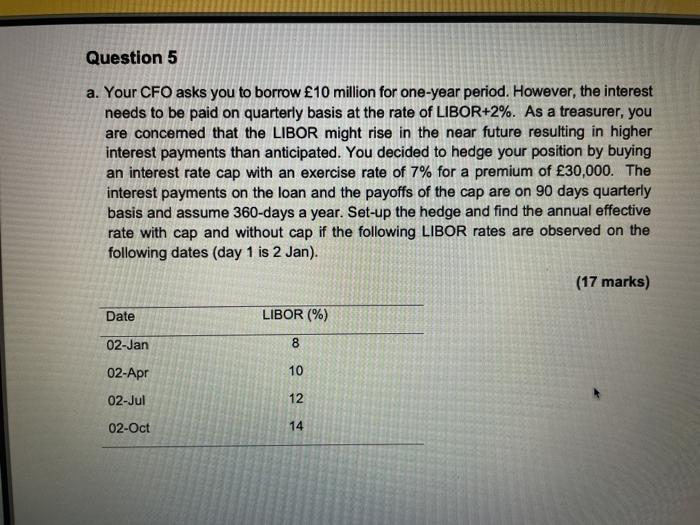

Question 5 a. Your CFO asks you to borrow 10 million for one-year period. However, the interest needs to be paid on quarterly basis at the rate of LIBOR+2%. As a treasurer, you are concemed that the LIBOR might rise in the near future resulting in higher interest payments than anticipated. You decided to hedge your position by buying an interest rate cap with an exercise rate of 7% for a premium of 30,000. The interest payments on the loan and the payoffs of the cap are on 90 days quarterly basis and assume 360-days a year. Set-up the hedge and find the annual effective rate with cap and without cap if the following LIBOR rate are observed on the following dates (day 1 is 2 Jan). (17 marks) Date LIBOR (%) 02-Jan 8 02-Apr 10 02-Jul 12 02-Oct 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts