Question: QUESTION 5 AND 6 PLEASE, DO NOT SOLVE QUESTION. 1 TO 4, JUST QUESTION 5 AND 6 For Questions 1 to 6, consider the following

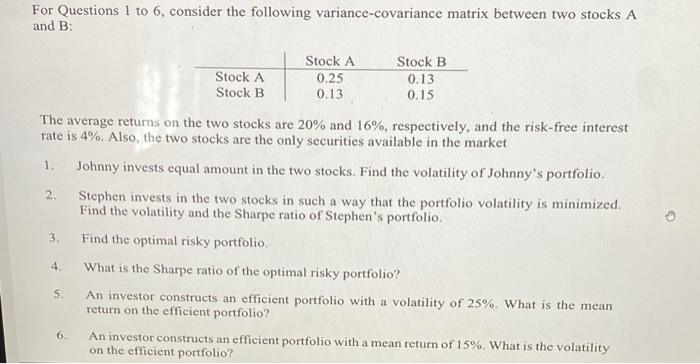

For Questions 1 to 6, consider the following variance-covariance matrix between two stocks A and B: Stock A Stock B Stock A 0.25 0.13 Stock B 0.13 0.15 2 The average returns on the two stocks are 20% and 16%, respectively, and the risk-free interest rate is 4%. Also, the two stocks are the only securities available in the market 1. Johnny invests equal amount in the two stocks. Find the volatility of Johnny's portfolio. Stephen invests in the two stocks in such a way that the portfolio volatility is minimized. Find the volatility and the Sharpe ratio of Stephen's portfolio 3. Find the optimal risky portfolio 4. What is the Sharpe ratio of the optimal risky portfolio? 5 An investor constructs an efficient portfolio with a volatility of 25%. What is the mean return on the efficient portfolio? 6. An investor constructs an efficient portfolio with a mean return of 15%. What is the volatility on the efficient portfolio? For Questions 1 to 6, consider the following variance-covariance matrix between two stocks A and B: Stock A Stock B Stock A 0.25 0.13 Stock B 0.13 0.15 2 The average returns on the two stocks are 20% and 16%, respectively, and the risk-free interest rate is 4%. Also, the two stocks are the only securities available in the market 1. Johnny invests equal amount in the two stocks. Find the volatility of Johnny's portfolio. Stephen invests in the two stocks in such a way that the portfolio volatility is minimized. Find the volatility and the Sharpe ratio of Stephen's portfolio 3. Find the optimal risky portfolio 4. What is the Sharpe ratio of the optimal risky portfolio? 5 An investor constructs an efficient portfolio with a volatility of 25%. What is the mean return on the efficient portfolio? 6. An investor constructs an efficient portfolio with a mean return of 15%. What is the volatility on the efficient portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts