Question: Question 5 Answer ALL parts to the question. a) Forge Ple has entered into a construction contract, contract X and Amalgamate Ple has entered into

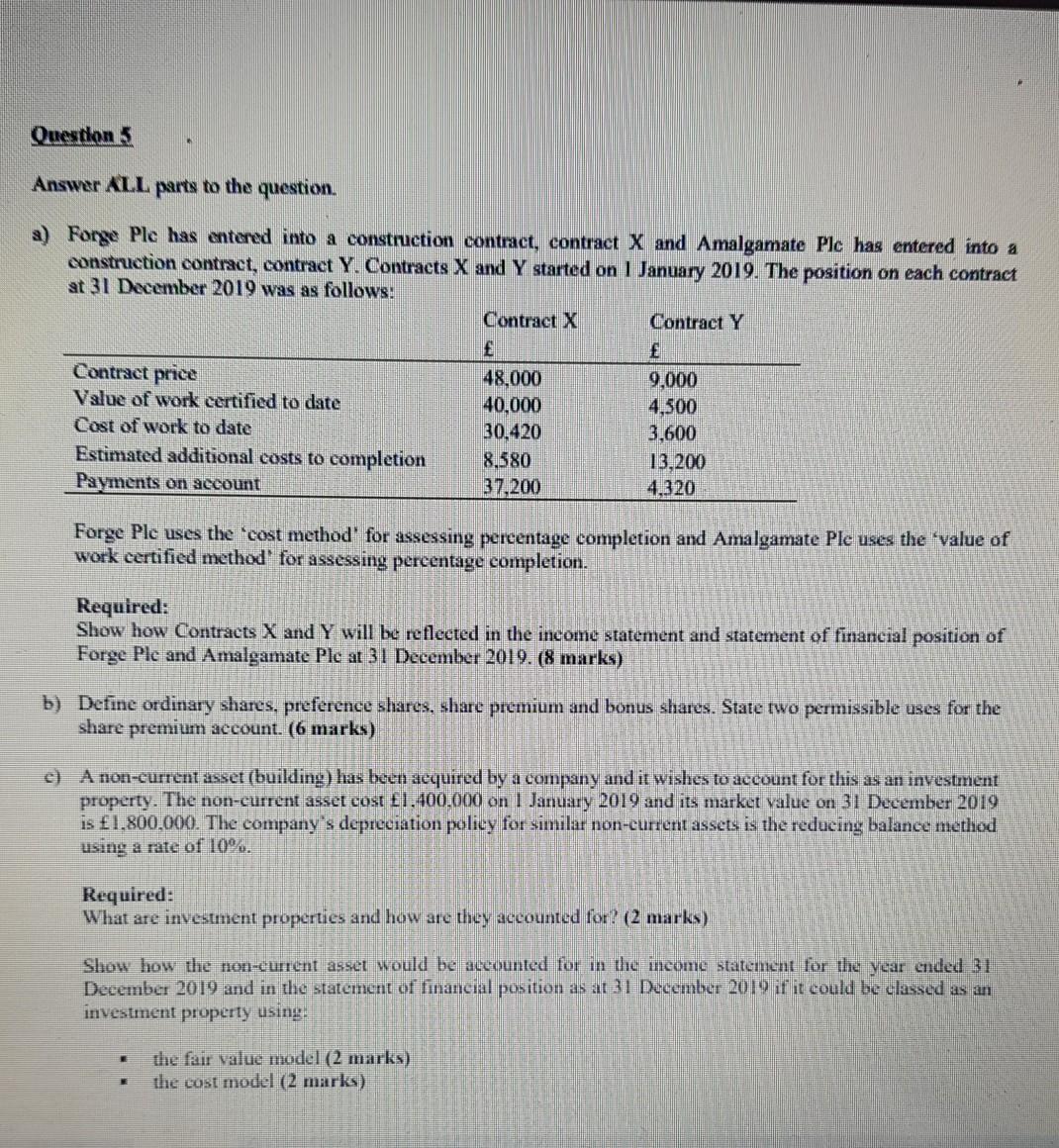

Question 5 Answer ALL parts to the question. a) Forge Ple has entered into a construction contract, contract X and Amalgamate Ple has entered into a construction contract, contract Y. Contracts X and Y started on January 2019. The position on each contract at 31 December 2019 was as follows: Contract X Contract Y Contract price 48,000 9,000 Value of work certified to date 40,000 4,500 Cost of work to date 30,420 3,600 Estimated additional costs to completion 8.580 13,200 Payments on account 37.200 4,320 Forge Plc uses the cost method for assessing percentage completion and Amalgamate Ple uses the value of work certified method for assessing percentage completion. Required: Show how Contracts X and Y will be reflected in the income statement and statement of financial position of Forge Plc and Amalgamate Plc at 31 December 2019. (8 marks) b) Define ordinary shares, preference shares, share premium and bonus shares. State two permissible uses for the share premium account. (6 marks) e) A non-current asset (building) has been acquired by a company and it wishes to account for this as an investment property. The non-current asset cost 1.400.000 on 1 January 2019 and its market value on 31 December 2019 is 1,800,000. The company's depreciation policy for similar non-current assets is the reducing balance method using a rate of 10%. Required: What are investment properties and how are they accounted for? (2 marks) Show how the non-current asset would be accounted for in the income statement for the year ended 31 December 2019 and in the statement of financial position as at 31 December 2019 if it could be classed as an investment property using: the fair value model (2 marks) the cost model (2 marks) Question 5 Answer ALL parts to the question. a) Forge Ple has entered into a construction contract, contract X and Amalgamate Ple has entered into a construction contract, contract Y. Contracts X and Y started on January 2019. The position on each contract at 31 December 2019 was as follows: Contract X Contract Y Contract price 48,000 9,000 Value of work certified to date 40,000 4,500 Cost of work to date 30,420 3,600 Estimated additional costs to completion 8.580 13,200 Payments on account 37.200 4,320 Forge Plc uses the cost method for assessing percentage completion and Amalgamate Ple uses the value of work certified method for assessing percentage completion. Required: Show how Contracts X and Y will be reflected in the income statement and statement of financial position of Forge Plc and Amalgamate Plc at 31 December 2019. (8 marks) b) Define ordinary shares, preference shares, share premium and bonus shares. State two permissible uses for the share premium account. (6 marks) e) A non-current asset (building) has been acquired by a company and it wishes to account for this as an investment property. The non-current asset cost 1.400.000 on 1 January 2019 and its market value on 31 December 2019 is 1,800,000. The company's depreciation policy for similar non-current assets is the reducing balance method using a rate of 10%. Required: What are investment properties and how are they accounted for? (2 marks) Show how the non-current asset would be accounted for in the income statement for the year ended 31 December 2019 and in the statement of financial position as at 31 December 2019 if it could be classed as an investment property using: the fair value model (2 marks) the cost model (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts